July 2003

Background | Oil | Natural Gas | Coal | Electricity | Environment | Profile | Links

Brazil

Brazil is the largest country in South America and

has experienced rapidly expanding oil, natural gas, and electricity

markets in recent years. The country is in the process of recovering

from an energy crisis in 2001.

Note: information contained in this report is the best available as of July 2003 and is subject to change.

BACKGROUND

BACKGROUND

In October 2002, Luiz Inacio Lula da Silva was elected president,

replacing Fernando Henrique Cardoso. The election marked a return

of the left to power, 38 years after a military coup overthrew President

Joao Goulart of the Brazilian Labor Party (PTB). President da Silva

was elected with the support of an alliance composed of his own

leftist Workers' Party, the PT, the center right Liberal Party,

(PL), the National Mobilization Party (PMN), the Popular Socialist

Party (PPS, formerly the PCB), and the Communist Party of Brazil

(PCdoB). During his election campaign, Mr. da Silva promised to

lead campaigns against hunger (Zero Hunger Initiative) and for increased

social spending in the areas of health, education and public security.

The new government continues to work on reforming the pension system

and the tax code after submitting two bills to the Congress in late

spring.

President da Silva's election initially resulted in a weakening of the Brazilian currency, as investors feared the impact of the new government's social agenda. However, after the new administration indicated that reforms will take a long time, and introduced fiscal austerity policies, the real climbed in value. Despite a weak international economy and the lingering effects of the 2001 energy crisis, the Brazilian economy has remained resilient, managing to post 1.5% real gross domestic product (GDP) expansion in 2002.

In June 2003, Brazil signed two energy cooperation agreements with the United States. As part of the agreements, the two countries will begin discussion on collaborating on hydrogen and fuel cells, making Brazil the first Latin American country to join the Bush administration's proposed International Partnership for the Hydrogen Economy. Brazil and the United Stated also signed a bilateral agreement on electricity deregulation, offshore safety, and the development of clean energy technologies, as well as began negotiations for Brazil to become a charter member of the Carbon Sequestration Leadership Forum.

OIL

Brazil contains the second largest oil reserves in South America

(after Venezuela), at 8.3 billion barrels. The country continues

to strive for self-sufficiency in oil production by 2006 and has

made positive steps towards reaching this goal. In May 2003, Petrobrás

announced that it plans to invest $34 billion over the next four

years, mainly in exploration. The state-owned oil company also expects

its average domestic oil production (not including production from

other companies) to reach 1.82 million barrels per day (bbl/d) by

2005.  The drivers behind the increase are a number of new fields coming

onstream and improved production performance, according to Petrobrás.

However, new government regulations (see below) have delayed the

construction of new floating production platforms, which resulted

in Petrobrás downgrading its initial production estimate of 1.9

milliuon bbl/d by 2005.

The drivers behind the increase are a number of new fields coming

onstream and improved production performance, according to Petrobrás.

However, new government regulations (see below) have delayed the

construction of new floating production platforms, which resulted

in Petrobrás downgrading its initial production estimate of 1.9

milliuon bbl/d by 2005.

Overall, total oil production has been rising steadily since the early 1990s, averaging nearly 1.6 bbl/d in 2002. The offshore Campos Basin, north of Rio de Janeiro, is the country's most prolific production area (see map below). Brazil's oil consumption for 2002 was estimated at almost 2.2 million bbl/d. Brazil's oil imports come mostly from Africa and the Middle East and, to a lesser extent, from Venezuela and Argentina, according to 2000 data.

Petrobrás is seeking to expand its oil and natural gas operations outside of Brazil. In October 2002, The company acquired a majority stake in Argentina's Perez Companc, increasing its oil and natural gas reserves significantly.

Exploration and Production

Petrobrás is the only company to have made commercially

viable discoveries in Brazil in recent years. Most of these are

located in the northern Campos Basin, along the coast of Espirito

Santo State, at block BC-60. In June 2003, Petrobrás announced that

it had made three new discoveries in the block. These finds follow

a previous discovery in May 2003 and in March 2003, at the Sergipe

offshore SEAL 100 block.

Petrobrás is the only company to have made commercially

viable discoveries in Brazil in recent years. Most of these are

located in the northern Campos Basin, along the coast of Espirito

Santo State, at block BC-60. In June 2003, Petrobrás announced that

it had made three new discoveries in the block. These finds follow

a previous discovery in May 2003 and in March 2003, at the Sergipe

offshore SEAL 100 block.

International Companies

Despite exploration efforts, Total, BP and ConocoPhillips have yet

to find an oil field in Brazil that is large enough to be commercialized.

According to these companies, recent discoveries are small and located

in deep waters, and the oil contained in the fields is extremely

viscous, requiring expensive recovery processes. In July 2003, Total

announced plans to scale back on exploration activities for the

time being and did not plan to take part in the next oil exploration

and production licensing round, set for August 2003. Consulting

firm Wood MacKenzie released a report in June 2003 stating that

the lack of recent commercial discoveries will impact Brazil's mid-to-long-term

oil production, with decline possibly starting in 2007 (Please see

graph below). Wood MacKenzie added that a change in fiscal terms,

attached to exploration and production activities, could make some

fields commercially viable. Although Brazil has large oil reserves,

increases in production will be depend on attracting investment

and on new technologies that would help lower recovery costs.

Repsol-YPF is currently the only international oil company producing

oil in Brazil. Shell is expected to begin producing 70,000 bbl/d

at the deepwater Bijupira-Salema field in the Campos Basin by mid-2003.

The company is the majority shareholder (80%) while Petrobrás holds

the rest. In May 2003, Shell also received permission to export

oil.

Repsol-YPF is currently the only international oil company producing

oil in Brazil. Shell is expected to begin producing 70,000 bbl/d

at the deepwater Bijupira-Salema field in the Campos Basin by mid-2003.

The company is the majority shareholder (80%) while Petrobrás holds

the rest. In May 2003, Shell also received permission to export

oil.

Accidents and the Environment

Over the years, poor safety and

environmental records

have tarnished Petrobrás' image. In March 2001, explosions

on the deepwater platform P-36, located at the Roncador field, caused

the world's largest platform to sink into the Atlantic Ocean. Production

at the Roncador stopped but was brought back onstream in December

2002. In October 2002, platform P-34 had to be evacuated when the platform

tilted to 32 degrees. The platform was saved but not without disrupting

production. Brazil's state environmental agency also fined the company

for running oil operations without the required environmental licenses.

Petrobrás plans to improve both its safety and environmental records.

Sector Organization

Prior to 1997, Petrobrás, which was created in 1953, monopolized

rights to explore, produce, refine, and distribute oil in Brazil.

Prices for Petrobrás oil were also fixed. In 1997, the former President

Cardoso signed the Petroleum Investment Law. The law permitted joint

ventures between foreign oil companies and Petrobrás. The law also

opened up Brazil's sedimentary basins to drilling operations by

foreign and Brazilian firms. The new law also created National Petroleum

Agency (ANP), charged with issuing tenders, granting concessions

for domestic and foreign companies, and monitoring the activities

of the sector, including establishing rights to explore for and

develop oil and natural gas in Brazil. One of the main drivers behind

opening the oil sector was to increase oil production in order to

reduce dependence on oil imports and eventually achieve self-sufficiency.

Most of Brazil's reserves were and remain located offshore in deep

water, requiring extensive capital investment to develop.

In July 1998, ANP announced that more than 92% of the nation's sedimentary basins were to be put up for bidding by other oil companies. Also in 1998, oil prices in Brazil became linked to world oil prices. In August 2000, the government sold a 28.5% stake in Petrobrás. In January 2002, the company lost its monopoly on importing oil and refined products.

New Government

After taking office, President da Silva began showing signs of reversing

some of the privatization policies of the former administration.

For instance, the government now requires companies which are awarded

oil and natural gas leases to devote a percentage of their investments

to

purchase goods and services provided by Brazilian firms

. This requirement fulfills one of President da Silva's electoral

promises to increase the role of the domestic industry in developing

the country's oil and natural gas reserves. During the presidential

campaign, Mr. da Silva stated that the oil platforms P-51 and P-52

should be built domestically in order to create economic growth.

In July 2003, Petrobrás launched a bidding round for the building of P-54 production platform. According to the new regulations, the project will require between 60% and 75% of the parts to be constructed in Brazil

Tax in Rio de Janeiro State

On June 30, 2003, the governor of Rio de Janeiro signed a bill that

imposes an 18% tax on oil production, but then suspended its implementation

in the face of strong opposition from oil companies (Shell and ChevronTexaco)

operating in the country. If the tax is eventually approved, it

will be applied at the wellhead, but not to exports, sparing foreign

companies producing oil in Brazil. Nonetheless, some analysts suggest

that the new tax would further discourage interest from foreign

companies, as they have already expressed concern about recent small

oil finds. In addition, these finds are mainly heavy crude and at

great depths, which only increases production costs.

International Cooperation

Brazil and Venezuela have held talks discussing potential oil and

natural gas partnerships between Petrobrás and Petroleos de Venezuela

(PDVSA). Activities include heavy crude oil refining, exploration,

production, as well as joint ventures in the petrochemicals and

natural gas sectors. The first project could be a partnership in

constructing a new heavy crude refinery, which Petrobrás intends

to build.

Bid Rounds

Since opening up the oil industry, ANP has held four bidding rounds.

The fifth round, planned for August 19-20, 2003, differs in several

ways from previous rounds. The government decided (as mentioned

above) to require increased inclusion of local equipment and services

related to oil operations. Second, a majority of the blocks up for

bid are small and located in shallow waters, whereas previous rounds

offered larger blocks. ANP hopes to attract smaller oil companies

to bid on these blocks. In all, 1,075 blocks will be up for bidding,

of which 262 are located onshore, 742 in shallow waters, and 71

in deep waters, according to ANP. Finally, analysts have suggested

that this round is less attractive for larger companies than previous

rounds, citing uncertainties about taxes, lack of recent commercial

discoveries, the geological challenge of oil recovery in deep waters,

and new opportunities for oil companies in the Middle East.

Previous Rounds

Foreign companies first became involved in the Brazilian oil sector

in 1997, through joint-ventures with Petrobrás. The first bidding

round that allowed foreign companies to compete against Petrobrás

occurred in 1999. The blocks for offer in the round, which were

extremely large (the average size of each area was 1,800 square

miles, equivalent to 225 blocks in the Gulf of Mexico), were sold

to 10 foreign firms, as well as to Petrobrás, which won 5 of the

12 blocks. Foreign firms, such as Agip, Unocal, Texaco, Amerada

Hess, Repsol-YPF, and ExxonMobil made successful exploration bids,

with some acting in alliance with Petrobrás. Most of the bids were

for relatively unexplored but highly coveted areas in over 6,560

feet (2,000 meters) of water off Brazil's Atlantic coast.

In June 2000, Brazil's second licensing round offered 23 blocks in nine sedimentary basins, including Campos (the Campos Basin is responsible for roughly 70% of the country's current total crude oil output), Amazonas, Camamu-Almada, Parana, Para-Maranhao, Potiguar, Reconcavo, Sergipe-Alagoas, and Santos. The second round was hailed as more successful than anticipated, with Petrobrás winning many bids in partnerships with foreign companies. The Campos and Santos Basin blocks generated the most interest, receiving as many as four bids. Only two blocks received no bids.

Brazil's third bidding round, held in June 2001, offered 53 blocks, 43 offshore, and mostly in deep and ultra-deep water areas. Although about a third of the offered blocks received no bids, the round was considered a success because of the wide range of aggressive bidders that participated. The bidding round attracted major international oil companies, such as ExxonMobil, Royal Dutch/Shell, Total, and Statoil, as well as some smaller companies that were new to the Brazilian oil sector, such as U.S.-based Ocean Energy and Germany's Wintershall. As in the previous rounds, Petrobrás was the largest benefactor, winning 13 blocks and joint venture partner in two others (with operators ExxonMobil and Total).

The fourth round offered 39 offshore and 15 onshore blocks. Eight blocks were in "frontier areas" and six were in the Campos Basin. The average block size was considerably larger than those in the third round. The auction was held in June 2002, with Petrobrás once again the largest winner. Statoil, El Paso, and several other companies increased their investments in Brazil. ( Complete round results are available from brasil.gov )

Downstream

Petrobrás plans to invest $5.5 billion by 2007 to increase domestic

refining capacity by 300,000 bbl/d, to 1.9 million bbl/d, and to

upgrade many of its refineries. One of the goals of the da Silva

administration is to increase Brazil's ability to refine heavy crude

oil, which makes up a large portion of the country's crude oil production.

In April 2003, Petrobrás revealed plans to build a 150,000-bbl/d

refinery, which would be the first one in Brazil to process heavy

crude. It remains unclear where the refinery will be built and whether

it will be built in conjunction with Venezuela's PDVSA (see above).

There are 13 crude oil refineries in Brazil, 11 of which belong to Petrobrás and comprise almost 99% of total refinery capacity.

NATURAL GAS

Brazil's natural gas consumption and production in Brazil rose steadily

throughout the 1990s, with imports beginning in 1999 as demand outstripped

supply. Natural gas production reached its highest level in 2000

at 257 billion cubic feet (Bcf), but declined in 2001 by 18% mainly

due to an economic downturn. Consumption, however, continues to

increase, reaching an estimated 339 Bcf in 2001. As of January 2003,

natural gas reserves stood at 8.1 trillion cubic feet (Tcf), the

fifth largest in South America behind Venezuela, Argentina, Bolivia,

and Peru.

Industry Organization

Natural gas exploration and production historically have been carried

out by Petrobrás. Upstream privatization has not progressed as

quickly with natural gas as it has with oil. Distribution, however,

traditionly has been handled at the state level. In accordance with

Brazil's national privatization agenda, plans are underway to privatize

parts of the country's natural gas sector. Because Brazil maintains

a highly federalized government system, many state governments are

now shouldering heavy fiscal responsibilities. In an effort to raise

necessary working capital, state governments have begun to sell

their state natural gas distribution companies. Natural gas distribution

companies in Rio de Janeiro and Sao Paulo are now in private hands.

Exploration

The Campos and Santos basins hold the largest Brazilian natural

gas fields. Other natural gas basins include Foz do Amazonas, Ceara

e Patiguar, Pernambuco e Paraíba, Sergipe/Alagoos, Espírito and

Amazonas (onshore). Offshore southeast Brazil is hydrocarbon rich

yet under explored, leaving potential for significant increases

in reserves and production. In May 2003, Petrobrás confirmed Brazil's

largest natural gas discovery to date, an estimated 2.45 Tcf, on

Block BS-400 in the Santos Basin.

Promotion of Natural Gas

Promotion of Natural Gas

Unlike the previous administration, the da Silva government wants

hydroelectricity to remain Brazil's main source of power. In the

late-1990s, the Brazilian government under former President Cardoso

had been encouraging the use of natural gas in an attempt to reduce

the country's dependence on hydropower. In the past, hydroelectric

plants were able to keep pace with Brazil's growing demand for electricity,

but rapid electricity demand growth in the 1990s resulted in power

cuts, blackouts and rationing programs.

In 1997, the government set out to increase natural gas' share of total energy consumption from 2.5% to 12% by 2002. Along with encouraging the construction of natural gas-fired power plants, Petrobrás signed a 20-year take-or-pay commitment with Bolivia to import natural gas through the long-awaited Brazil-Bolivia (Gasbol) pipeline, which came onstream in June 1999. At the original signing of the contract, the supply volume was tied to Brazil building 16 natural-gas-fired power plants. Out of the 16 plants, Petrobrás has pulled out of six planned projects and is contemplating its role in two others. On a positive note, EdF announced in July 2003 that it plans to restart construction of the $400 million Paracambi thermoelectric power plant. EdF also plans to begin operation later this year of its 720MW Norte Fluminense thermoelectric plant.

Natural Gas Consumption

Economic developments hindered the Cardoso administration's efforts

to enlarge Brazil's market for natural gas. The devaluation of

the real in January 1999, for example, made natural gas imports

from Bolivia more expensive, as power producers had to pay for natural

gas in dollars. In addition, a severe recession deterred banks from

making loans to power developers, who were expected to absorb nearly

half of the Bolivian imports. All of these effectively disrupted

the construction of natural gas-fired power plants.

In 2001, a shortage of hydroelectricity due to a drought led the Cardoso administration to launch the Priority Thermal Power Program . The program envisaged development of 55 new natural gas-fired plants over eight years with a combined capacity of 23,000 MW. However, the plan was discontinued when rains returned along with the availability of cheap hydroelectricity. A majority of the new plants were subsequently put on hold indefinitely. In July 2002, metal manufacturers, such as Canadian Alcan, U.S. Alcoa and BHP Billiton in conjunction with power producers Tractebel, increased their commitment to hydroelectricity to support expanding their output. The Brazilian energy regulator Aneel awarded the companies concessions to build and operate eight new hydro plants. The companies indicated that they could not wait any longer for natural gas to meet their energy requirements.

New Developments: Bolivian Imports

Since signing an agreement with Bolivian state natural gas exporter

YPFB in 1997, Brazil has taken only a fraction of the natural gas,

to which it had agreed. Government delegations from Bolivia and

Brazil have met repeatedly over the last six months in attempt to

renegotiate the contract. Brazil wants to import less and pay less

for natural gas from Bolivia, suggesting a more flexible agreement.

Bolivia indicated after a meeting held in May 2003 that it would

not change the contract unless Brazil would guarantee that exports

would increase in the future.

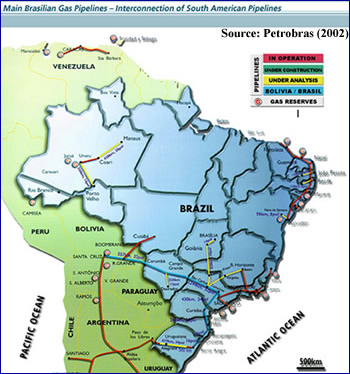

In response, the Brazilian government revealed in June 2003 its new Natural Gas Expansion Project. The objective of the plan is to expand the country's natural gas pipeline network (see pipelines below), bringing natural gas to residential, industrial, and thermal power plants, particularly to southeastern and northeastern regions of the country where no pipelines currently exist, and which now rely on fuel oil. One of the drivers of the project is Brazil's commitment to expanding the domestic natural gas market as part of its ongoing negotiations with Bolivia.

Pipelines

Brazil has two existing international pipeline connections, with

several more under construction. The first pipeline to connect Brazil

to foreign natural gas sources was the Bolivia-to-Brazil pipeline

(Gasbol), tapping Bolivia's Rio Grande sources. The completed

covers almost 2,000 miles, and came onstream in June 1999, with

service to Sao Paulo and a terminus in Porto Alegre. The pipeline

continues to operate well below its 1.05 billion cubic feet per

day capacity, due to the high price of dollar-denominated Bolivian

natural gas and the minimal development of natural gas-fired generating

capacity in Brazil. As a result, the Brazilian government has suspended

plans to expand the Brazil-Bolivia pipeline.

In 2002, BG signed nine-year agreement with Petrobrás, guaranteeing

access to 22.8 million cubic feet per day from the pipeline from

January 1, 2003 to December 31, 2011. Enron and El Paso Energy announced

in February 2003 that they plan to sell their stakes in the pipeline

as the expected revenue from the project has yet to materialize.

In 2002, BG signed nine-year agreement with Petrobrás, guaranteeing

access to 22.8 million cubic feet per day from the pipeline from

January 1, 2003 to December 31, 2011. Enron and El Paso Energy announced

in February 2003 that they plan to sell their stakes in the pipeline

as the expected revenue from the project has yet to materialize.

Brazil's second operational international natural gas pipeline links Paraná, Argentina, to Uruguaiana, Brazil. The pipeline, Transportadora de Gas del Mercosur, is 270 miles long. The pipeline supplies natural gas to a $350-million, 600-megawatt (MW) AES power plant in Uruguaiana. Service began in July 2000. The Argentinean government is currently promoting a 384-mile pipeline extension, the Transportadora Sulbrasileira de Gas (TSB), which would connect Uruguaiana to Porte Alegre . However, the project most likely will not proceed until there is a decision on constructing two new natural gas-fired power plants in Porto Alegre.

New Pipeline Developments

Petrobrás recently released a statement that it is conducting a

feasibility study on a 745-mile pipeline that would link Brazil's

southeast and northeast networks, allowing it to transport natural

gas from neighboring Bolivia and from Petrobrás' fields in the Santos

Basin to the northeast.

Petrobrás also is negotiating with the states of Amazonas and Rondonia to build a 342-mile Urucu to Porto Velho pipeline. The pipeline is expected to supply 80.5 million cubic feet per day, mainly to power a 404 MW thermoelectric plant owned by El Paso and CS Participacoes. Environmental licensing problems have delayed the construction of the pipeline. In the same region, Petrobrás is proceeding with plans to build a 261-mile Coari to Manaus pipeline to be able to supply natural gas from the Urucu field to regional industry.

In January 2003, Argentinean natural gas began to flow to Montevideo, Uruguay, through the Gasoducto Cruz del Sur (GCDS, Southern Cross pipeline). The pipeline is significant because the GCDS project includes a concession covering a possible extension from Uruguay to Porto Alegre in southern Brazil. Partners in the project are British Gas (40%), Pan American Energy (30%), Uruguayan state company ANCAP (20%) and Wintershall (10%). ( For more details on natural gas distributors in Brazil ).

Liquefied Natural Gas (LNG)

In January 2003, Petrobrás announced the development of a plan

to bring stranded natural gas reserves in the Amazon to the market.

The Green LNG project would pipe natural gas from the Jurua,

Uruco, and Polo Arara fields to a floating liquefaction plant on

the Amazon River near the existing Solimoes refinery. At the refinery,

the natural gas would be liquefied and loaded onto a specially designed

LNG transport vessel, then shipped to a smaller 1.5-million-ton-per-year

capacity regasification terminal located in Suapeto. The vessel

would have a capacity of 3.5 million cubic feet in order to be able

to navigate the Amazon River. According to Petrobrás, the next steps

of the project include a more rigorous feasibility study.

COAL

Brazil's recoverable coal reserves are estimated at approximately

13.1 billion short tons of lignite and sub-bituminous coal, the

largest coal reserves in Latin America. Much of Brazil's coal is

characterized by high ash and sulfur contents, as well as low caloric

values. Overall, Brazil's coal production in 2001 was approximately

4.53 million short tons (Mmst), while consumption was an estimated

20.8 Mmst, with net imports of 16.3 Mmst.

Coal is used predominantly for Brazil's domestic steel industry, with a small portion burned to generate electricity. A 1996 study by the International Energy Agency (IEA) concluded that Brazil will continue to be one of the world's major coal importers during the next 10 to 15 years, with imports possibly doubling by 2010. The country's steel industry is expected to remain the largest domestic coal consumer for the foreseeable future. Brazil plans to increase its use of steam coal (both domestic and imported) for electric power generation.

ELECTRICITY

ELECTRICITY

Brazil has installed electric capacity of 73.4 million kilowatts,

85% of which is hydropower (as of January 1, 2001). Of the 321.2

billion kilowatthours (bkwh) generated in Brazil in 2001, 83% was

from hydropower (down from 91% in 1999). Brazil ranks consistently

as one the world's top hydropower producers. Together with Paraguay,

Brazil maintains the world's largest operational hydroelectric complex,

the Itaipu facility on the Paraná River, with a capacity of 12,600

megawatts (MW). Brazil's remaining electricity generation capacity

comes from coal and an increasing amount from natural gas. Brazil's

small northern and larger southern electrical grids were joined

in January 1999 into one grid that serves 98% of the country. Brazil's

domestic supply is augmented by imports from neighboring Argentina.

Electricity Shortage

In 2001, Brazil faced a critical electricity shortage. The shortage

was a result of insufficient rainfall, as well as under investment

in the industry. Several years of below-average rainfall left reservoirs

70% depleted. During the 1990s, energy demand, on account of a growing

economy and a rising standard of living, had been consistently outstripping

increments ingeneration capacity. In 2000, consumption was about

58% higher than it was in 1990, while installed generation capacity

grew about 32% during the same period. Analysts had long predicted

that this demand growth, if not supported by capacity growth, had

the potential to lead to shortages.

The government implemented an energy-rationing program in June 2001, which prevented rolling blackouts by requiring customers to reduce consumption by 20%. Restrictions were most severe in the heavily populated southeast and central-west regions, and northeastern states had three mandatory holidays declared in the autumn of 2001 in order to reduce demand. Restrictions ending on March 1, 2002.

New Developments

Once the government lifted the rationing program, the country found

itself facing a power glut. This pushed many electricity companies

deep into debt, such as Cemar, Eletropaulo Metropolitana, Cesp,

Cemig and AES. The power glut has reduced incentives for companies

to begin construction of thermoelectric power plants. In July 2003,

the Energy and Mines Minister Dilma Roussef warned that country

could face another power crisis by 2007, particularly if the economy

begins to rebound. A report from the Brazilian Basic Infrastructure

and Industry Association reported that the country would need to

invest around $4.8 billion annually through 2020 to sustain moderate

growth and avoid another crisis.

In July 2003, Brazilian Energy Minister Dilma Rousseff revealed

a new model for the electricity sector, with the goals of ensuring

reliable supply, stabilizing prices for consumers and attracting

long-term investment to the sector. One of the proposed reforms

included pooling cheaper hydroelectricity with more expensive thermoelectric

plants (natural gas). By pooling the various sources, the ministry

hopes to reduce the electricity tariffs and to ensure power is purchased

from the newly constructed thermal plants, which have yet fully

amortized. The Brazilian government plans to implement the program

by January 2004.

In July 2003, Brazilian Energy Minister Dilma Rousseff revealed

a new model for the electricity sector, with the goals of ensuring

reliable supply, stabilizing prices for consumers and attracting

long-term investment to the sector. One of the proposed reforms

included pooling cheaper hydroelectricity with more expensive thermoelectric

plants (natural gas). By pooling the various sources, the ministry

hopes to reduce the electricity tariffs and to ensure power is purchased

from the newly constructed thermal plants, which have yet fully

amortized. The Brazilian government plans to implement the program

by January 2004.

As a first step in ensuring a more reliable supply, the government has put out tenders (July 2003) for the construction of a new transmission lines linking the north and south regions of the country. During the energy crisis, certain regions had excess supply but an insufficient transmission infrastructure restricted the flow of electricity, particularly to the southeast region, where are majority of Brazil's population and industry resides.

Sector Organization

Although generation remains mostly under government control and

transmission is not slated for privatization in the near term, distribution

is mostly in private hands. Regulatory difficulties have been blamed

for the lack of international interest in Brazilian electricity

distribution. New regulations in February and July 2002 aimed to

address these problems and boost investment.

After two 1995 laws restructured the industry and laid the groundwork for private investment, the process stalled in the wake of the country's 1999 currency devaluation. An estimated 80% of Brazilian electric generation remains in public hands. As part of the privatization program, three remaining major federally owned utilities, Eletronorte, Furnas Centrais Eletricas (Furnas) and the Companhia Hidroeletrica do Sao Francisco (Chesf), have been split into several smaller generating and distributing utilities. However, additional privatization of these companies has been ruled out by the Lula administration. Federal utility Eletrobrás controls about half of the country's installed capacity and most of the large transmission lines. Eletrobrás coordinates and supervises the expansion and operation of the generation, transmission and distribution systems. Private capital flows resulting from privatization had been expected to play a key role in bolstering the industry, especially as state-owned generators have not had investment capital available.

Nuclear Power

Brazil has two operational nuclear plants, Angra-1 and Angra-2,

and one under construction, Angra-3, although construction has stalled.

Angra-1 was bought from the U.S. company Westinghouse in 1969. The

Angra-2 plant came online in 2000, 23 years and $10 billion after

construction began. The nuclear program historically came under

the jurisdiction of the Ministry of Defense rather than the Ministry

of Mines and Energy, and decreased funding for the military translated

to delays in nuclear power plant construction. A government company,

Eletronuclear, now has been created to assume responsibility for

the plants.

New Developments

In 2003, the government plans to invest $35 million in the Angra

1 nuclear power plant. The money will be used to acquire two new

steam generators for the plant. The partly completed Angra 3 nuclear

power plant still requires a reportedly $1.7 billion to begin the

next construction steps.

Electrobrás has repeatedly appealed to the Brazil energy regulator ANEEL to authorize tariff hikes for nuclear power in order to raise the necessary funding for maintenance of the two operating power plants. Electronuclear, which runs the plants, is in debt and continues to have difficulty in raising the necessary revenues to conduct regular maintenance.

ENVIRONMENT

Brazil is a major player in discussions regarding the environment.

Brazil's Amazon rainforest comprises 30% of the world's remaining

tropical forests, and in addition to providing shelter to at least

one tenth of the world's plant and animal species, the rainforest

acts as a mechanism for absorbing carbon dioxide from the atmosphere.

Brazil is the largest energy

consumer in South America (consuming 8.78 quadrillion Btu of commercial

energy in 2001), and the third largest in the Western Hemisphere,

behind the United States and Canada. While total energy consumption

statistics place the country as prominent in the region, Brazil's

per capita energy consumption is comparable to the average

per capita

energy consumption for all of Central and South America. Brazil also

is the largest emitter of carbon dioxide in the region, releasing 95.8

million metric tons of carbon into the atmosphere in 2001. Although

Brazil's carbon emissions are fairly significant in the region,

carbon intensity

, the amount of carbon emitted per dollar of GDP, is comparatively

low.

One reason for the comparatively lower carbon intensity in Brazil

is the significant use of hydropower in the energy mix, as well

as the use of biofuels and other forms of

renewable energy

. One prominent biofuel in the Brazilian economy is

ethanol

. The ethanol program was initiated partially in response to the

oil shock of 1973, and partly as an alternative to oil to promote

self-sufficiency. The ethanol program also has been one of Brazil's

strategies to mitigate the environmental effects of rapid

urbanization

.

In January 1999, Brazil's Congress implemented an environmental

pollution law that fines polluters for environmental standards violations.

Industrial polluters have five years to come into compliance with

the new law, after which they can be fined between $50 and $50 million

dollars for violations.

COUNTRY OVERVIEW

President: Luiz Inacio Lula da Silva (elected 10/27/02)

Independence: September 7, 1822 (from Portugal)

Population (2002E): 174.6 million

Location/Size: Eastern South America/3.3 million square miles,

slightly smaller than the United States

Major Cities: Sao Paulo, Rio de Janeiro, Belo Horizonte,

Brasilia (capital)

Languages: Portuguese (official), Spanish, English, French

Ethnic Groups: white (55% - includes Portuguese, German,

Italian, Spanish and Polish), mixed (38%), black (6%), other (1%

- includes Japanese, Arab, and Amerindian)

Religions: Roman Catholic (80%)

Defense (8/98): Army (195,000), Navy (68,250), Air Force

(50,000), Public Security Forces (385,600)

ECONOMIC OVERVIEW

Currency: 1 Real (R) = 100 centavos

Exchange Rate (7/22/03): US$1 = R 2.96

Gross Domestic Product (GDP, 2002E): $451.7 billion

Real GDP Growth Rate (2002E): 1.5% (2003F): 2.4%

Inflation Rate (consumer prices, 2002E): 8.5% (2003F):

15.3%

Current Account Deficit (2002E): -1.72% of GDP

Merchandise Exports (2002E, $U.S.): $60 billion

Merchandise Imports (2002E, $U.S.): $47 billion

Net Merchandise Trade Surplus (2002E, $U.S.): 13

Major Trading Partners: United States, Argentina, Japan,

Germany, Italy

Unemployment Rate (2002E): 7.1% (2003F): 7.4%

Total External Debt (2002E): 208.2

Foreign Exchange Reserves (2002E): 37.7

ENERGY OVERVIEW

Minister of Energy and Mines: Dilma Rousseff

Proven Oil Reserves (1/1/03E): 8.3 billion barrels

Oil Production (2002E): 1.57 million barrels per day (bbl/d),

of which 1.3 million bbl/d was crude.

Oil Consumption (2002E): 2.17 million bbl/d

Net Oil Imports (2002E): 0.6 million bbl/d

Crude Oil Refining Capacity (1/1/03E): 1.87 million bbl/d

Natural Gas Reserves (1/1/03E): 8.1trillion cubic feet (tcf)

Natural Gas Production (2001E): 210 billion cubic feet (bcf)

Natural Gas Consumption (2001E): 339 bcf

Coal Reserves (2001): 13.1 billion short tons

Coal Production (2001E): 4.53 million short tons (Mmst)

Coal Consumption (2001E): 20.8 Mmst

Electric Generation Capacity (2001E): 73.4 gigawatts (85%

hydroelectric)

Net Electricity Generation (2001E): 321.2 billion kilowatthours

(bkwh)

Net Electricity Consumption (2001E): 336 bkwh

ENVIRONMENTAL OVERVIEW

Minister of Environment: Marina Silva

Total Energy Consumption (2001E): 8.78 quadrillion

Btu*

Energy-Related Carbon Emissions (2001E): 95.8 million

metric tons of carbon

Per Capita Energy Consumption (2001E): 50.9 million

Btu (vs. U.S. value of 341.8 million Btu)

Per Capita Carbon Emissions (2001E): 0.56 metric tons

of carbon (vs U.S. value of 5.5 metric tons of carbon)

Energy Intensity (2001E): 11,384 Btu/ $1995 (vs U.S.

value of 10,736 Btu/ $1995)**

Carbon Intensity (2001E): 0.12 metric tons of carbon/thousand

$1995 (vs U.S. value of 0.17 metric tons/thousand $1995)**

Fuel Share of Energy Consumption (2001E): Natural

Gas (4.01%), Oil (50.8%), Coal (5.92%)

Fuel Share of Carbon Emissions (2001E): Oil (79.8%),

Natural Gas (6.61%), Coal (13.6%)

Status in Climate Change Negotiations: Non-Annex I country

under the United Nations Framework Convention on Climate Change

(ratified June 4th, 1992). Signatory to the Kyoto Protocol (April

29th, 1998 and ratified on August 23, 2002).

Major Environmental Issues: Deforestation in Amazon Basin

destroys the habitat and endangers the existence of a multitude

of plant and animal species indigenous to the area; air and water

pollution in Rio de Janeiro, Sao Paulo, and several other large

cities; land degradation and water pollution caused by improper

mining activities

Major International Environmental Agreements: A party to

the Antarctic-Environmental Protocol, Antarctic Treaty, Biodiversity,

Climate Change, Desertification, Endangered Species, Environmental

Modification, , Law of the Sea, Marine Dumping, Nuclear Test Ban,

Ozone Layer Protection, Ship Pollution, Tropical Timber 83, Tropical

Timber 94, Wetlands and Whaling.

* The total energy consumption statistic includes petroleum, dry

natural gas, coal, net hydro, nuclear, geothermal, solar, wind,

wood and waste electric power. The renewable energy consumption

statistic is based on International Energy Agency (IEA) data and

includes hydropower, solar, wind, tide, geothermal, solid biomass

and animal products, biomass gas and liquids, industrial and municipal

wastes. Sectoral shares of energy consumption and carbon emissions

are also based on IEA data.

** GDP based on EIA International Energy Annual 2001.

ENERGY INDUSTRY OVERVIEW

Organization: Petroleo Brasileiro (Petrobrás)

- government-owned (majority shareholder) oil and natural gas company;

Centrais Eletricas Brasileira (Eletrobrás) - federal

holding company for planning and coordination of generation, transmission

and distribution of electrical power

Major Petroleum Terminals: Sao Sebastiao, Paranagua, Salvador,

Tramandai, Sao Francisco do Sul, Aracaju, Maceio, Recidfe, Natal,

Fortaleza, and Belem

Major Ports: Santos, Rio de Janeiro, Praia Mole, Vitoria,

Rio Grande

Major Oil and Gas Fields: Campos Basin (includes Marlim,

Albacora, and Barracuda fields), Santos Basin

Major Refineries (January 2003 capacity, all belonging to Petrobrás):

Paulinia - Sao Paulo (337,764 bbl/d), Mataripe-Bahia (283,734 bbl/d),

Duque de Caxias - Rio de Janeiro (232,213 bbl/d), Sao Jose dos Campos

- Sao Paulo (217,134 bbl/d), Canoas, Rio Grande do Sul (180,945),

Araucaria - Parana (180,945 bbl/d), Cubatao-Sao Paulo (162,851 bbl/d),

Betim-Minas Gerais (144,756 bbl/d)

Sources for this report include: Agência Nacional do Petróleo; Argus Latin American Energy and Latin American Power Watch; Business News Americas; CIA World Factbook; Global Insight; Dow Jones; Economist Intelligence Unit ViewsWire; Energy Day; Financial Times; Infopetro Bulletin; International Energy Agency; International Petroleum Finance; Latin America Monitor; Lloyd's List; New York Times; Oil Daily; Oil and Gas Journal; Olade; Petroleum Economist; Reuters; Platts; The Economist Intelligence Unit; U.S. Department of State; U.S. Energy Information Administration; Valor Economico; Wood MacKenzie Ltd.; World Gas Intelligence; World Markets Online.

LINKS

For more EIA information on Brazil, please see:

EIA - Historical Energy Data on Brazil

Links to other U.S. government sites:

CIA World Factbook - Brazil

U.S. State Department's

Consular Information Sheet - Brazil

U.S. State Department's Background Notes on Brazil

U.S.

Department of Energy's Office of Fossil Energy's Overview of Brazil

U.S Embassy in

Brazil

The following links are provided solely as a service to our customers,

and therefore should not be construed as advocating or reflecting

any position of the Energy Information Administration (EIA) or the

United States Government. In addition, EIA does not guarantee the

content or accuracy of any information presented in linked sites.

Results of Brazil's Fourth

Licensing Round

Brazilian Embassy in the United

States

Petrobrás

Eletrobrás

GásEnergia

Transportadora

Brasileira Gasoduto Bolivia-Brasil

Itaipu Hydroelectric Dam

National Organization of the Petroleum

Industry (ONIP)

LatinWorld's section

on Brazil

Brazil's National Privatization Program

as analyzed by Canada's Department of Foreign Affairs and International

Trade

National Law Center

InterAm Database -- Brazil

LANIC -- Brazil

Economy & Energy,

Brazil

WorldAtlas, Brazil

Brazilian Petroleum

Institute

Brazil Economic

Briefing by the Brazilian Embassy in Washington, DC

Institute of the

Americas

If you liked this Country Analysis Brief or any of our many other Country Analysis Briefs, you can be automatically notified via e-mail of updates. You can also join any of our several mailing lists by selecting the listserv to which you would like to be subscribed. The main URL for listserv signup is http://www.eia.doe.gov/listserv_signup.html . Please follow the directions given. You will then be notified within an hour of any updates to Country Analysis Briefs in your area of interest.

Return to Country Analysis Briefs home page

File last modified: July 23, 2003

Contact:

Lowell Feld

lowell.feld@eia.doe.gov

Phone: (202) 586-9502

Fax: (202) 586-9753