Global Investments in Renewable Energy are expected to reach $653.35 billion by 2015

May 14, 2010 - Sriram Peri - GBI Research - altenergymag.com

GBI Research, the leading business intelligence provider, has released its latest report “Renewable Energy Investment Opportunities in Emerging Economies” that gives an in-depth analysis of the emerging economies as upcoming renewable energy hotspots and provides investment forecasts up to 2015. The research analyzes the growth, evolution and investments in renewable energy market in emerging countries of the world. The study identifies potential hotspots for renewable energy investments in the world and analyzes the investment trends in emerging markets. The study provides a detailed analysis and investment forecasts in key emerging countries namely, China, India and Brazil. The report also provides a detailed analysis of financial investments by deal type in key emerging countries.

This report is built using data and information sourced from proprietary databases, primary and secondary research and in-house analysis by GBI Research’s team of industry experts.

Global Investments in Renewable Energy are expected to reach $653.35 billion by 2015

Investments in renewable energy increased from $39.24 billion in 2001 to $336.78 billion in 2009 at a CAGR of 30.8% during the period 2001-09. There is an increase in total investments in the renewable energy sector by 43.4% in 2009 from $283.11 billion in 2008. Global Investments in the renewable energy industry are mainly driven by policies and incentives offered by the respective federal governments in different countries. The investments in the industry are mainly aimed at creating employment opportunities and driving away the clouds of economic downturn in many nations. Investments in the renewable energy industry are likely to increase in the forecast period 2009-15 and are expected to reach $653.35 billion by 2015.

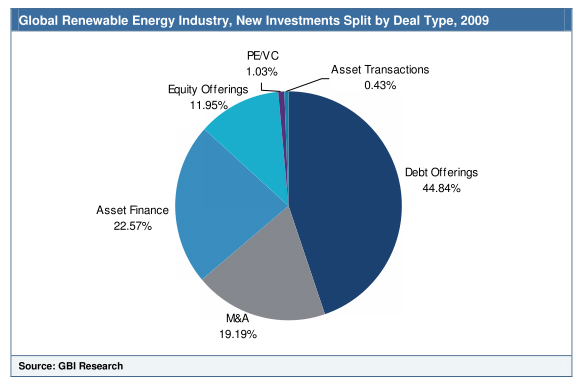

Debt offering is the major source of investment in the renewable energy, accounting for 44.84% of the total investments in 2009. It is followed by asset financing, which is another key source of investment with a contribution of 22.57% to the total renewable energy investments. Mergers and Acquisitions (M&A), which accounted for 19.19%, and equity offerings, which accounted for 11.95%, are the other major sources of investments in the industry.

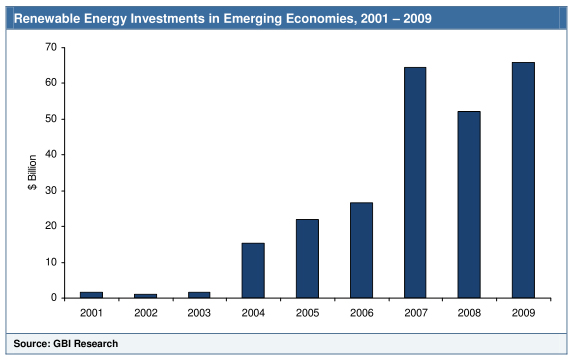

Investments in Emerging Economies reached $65.86 billion in 2009, an increase of 26.42% over 2008

Financial investments in emerging nations increased from $1.76 billion in 2001 to $65.86 billion in 2009 at a CAGR of 57.63% for the period 2001-09. China led the investments in Asia, with a total investment of $11.48 billion, mainly in wind and solar PV projects. Total investment in India grew over 100% to $7.17 billion in 2009, of which equity offerings accounted for $3.6 billion. Brazil accounted for most of the renewable energy investment in Latin America in 2009, attracting $7 billion of total investments.

Government Support and Financial Incentives are driving investments in Emerging Countries for Renewable Energy Development

Investments in renewable energy sector are largely dependent on the regulatory and financial support offered by the respective governments. The governments in emerging economies, in order to achieve energy security and carbon emission reduction, are promoting the use of renewable energy sources for power generation. The other major reason for promoting investments in renewable energy is the fluctuating energy price of fuel from conventional sources. Investments in the Chinese renewable energy market are driven by various renewable energy policies and incentives provided by the government. Regulatory restrictions on foreign investments have shielded the wind power market in China during the current global financial crisis. The government in China came up with various incentive plans and policies to promote the development of renewable energy, while two of the largest solar markets, Spain and Germany, are cutting back on their incentives. These policies have boosted and will continue to drive the domestic market and will also create attractive investment opportunities in the country. Similarly in India, the government came up with Generation Based Incentives (GBI), National Semi-conductor Policy and National Missions to attract investments in all segments of the renewable energy value chain, thereby driving renewable energy development.

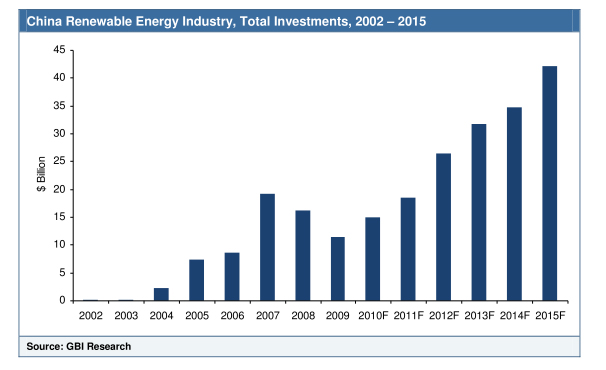

China is the Key Nation which led Financial Investments in Emerging Economies

Total investments in renewable energy industry in China have increased from $163 million in 2002 to around $11.48 billion by 2009 at a CAGR of 84%. Government support in the form of supportive policies is expected to drive the future investments in renewable energy sector in China. It is expected that the investments will grow from $9.38 billion in 2009 to around $42.25 billion by 2015.

Investments in renewable energy industry in India have increased from $94.58 million in 2001 to around $7.17 billion by 2009 at a CAGR of 72%. In 2009, India had 4.9 GW of newly installed renewable power (including hydro) of which 1.6 GW was contributed by wind and 2.89 GW was contributed by hydro power. The investment in renewable energy sector in India is expected to grow from $7.17 billion in 2009 to around $26.74 billion in 2015 at a forecast CAGR of 24.54%.

Brazil accounted for most of the renewable energy investment in the Latin America region. Investments in renewable energy industry in Brazil have increased from $614 million in 2004 to around $7 billion by 2009 at a CAGR of 62%. The country is the largest renewable energy market in the region. Renewable energy in Brazil is dominated by hydro and ethanol. The development of biofuels market in Brazil can be largely attributed to the large areas of cultivable land, government support, abundant water resources and cost advantage over competing fuels. In this backdrop, the investment in renewable energy sector in Brazil is expected to grow from $9.38 billion in 2009 to around $21.59 billion in 2015.

Technological advancements will drive investments in R&D of renewable energy

There is a drive for the development of new and sophisticated technology, which is more cost effective. Power generation from various renewable sources such as solar, wind, and hydro involves high upfront and operational costs, making it expensive for deployment in developing countries. Technological innovations are underway to make these sources more affordable and efficient, which will result in their wider application. Thus, technological innovations and research and development activities for renewable energy are gathering momentum.

For more information or to buy this report please click here: www.gbiresearch.com

|