Electric Transmission Investments

Needed to Unlock Enormous Wind Power Resources in

US

Feb 2, 2009 - emerging energy research

Cambridge, Massachusetts - The electric transmission

investments proposed in the new Obama administration’s

stimulus plan would have a major impact on wind power

development in the US, according to Emerging Energy

Research, a Cambridge MA advisory firm in the renewable

energy sector. EER has recently profiled nine of the

largest transmission initiatives under development

in the western United States, which alone are set

to unlock 57 GW of new wind power -- more than tripling

the existing wind power capacity in the US. While

most of these large-scale projects are not scheduled

for completion until after 2015, hundreds of smaller

transmission lines and grid upgrades can provide a

more immediate impact on wind power development in

the US.

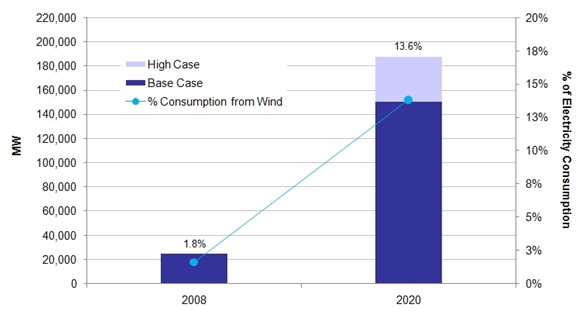

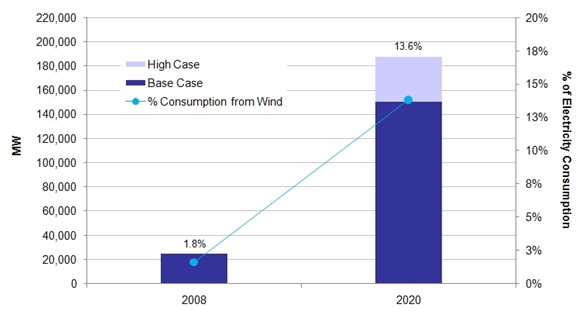

The US wind power industry finished 2008 at a record

pace, just ahead of EER’s 2008 base case forecast

of 8,203 MW – the American Wind Energy Association

reports 8,358 MW were installed at year-end. EER expects

a significant decline in 2009 projects due to the

curtailment of project and tax equity financing in

the current economic climate. But according to EER

president William Ambrose, “investments in new transmission

and other renewable policy provisions being considered

in the stimulus bill can go a long way towards maintaining

momentum in the industry.” EER’s high-growth wind

power forecast -- which factors in a national renewable

portfolio standard and stepped up investment in transmission

– estimates 187 GW of wind power capacity by 2020,

accounting for nearly 14% of total US power consumption.

Wind development in the United States remains constrained

by an inadequate and aging transmission infrastructure

that hampers the delivery of wind generated power

from regions of wind-rich resource to population centers

with growing clean energy demands. None of the nine

projects profiled by EER are expected to be fully

operational before 2013, and the timeframe for new

grid capacity is made even more uncertain as these

large projects face complex permitting and siting

hurdles. “Beyond investment, a significant amount

of initiative is required on a Federal level to fast

track permitting and siting of these projects,” says

Ambrose.

With none of the large-scale transmission initiatives

expected to come online between 2008 and 2012, annual

growth in the US wind market may stall at 8-9 GW per

year according to EER. “The inability of transmission

build-out to keep pace with wind project development

activity will increasingly constrain the growth of

the US wind power market in the near-term,” according

to EER senior wind analyst Matthew Kaplan.

The nine projects analyzed by EER will open up large

regions of wind resources stretching from Minnesota

to Southern California. In some regional transmission

areas (RTOs), such as the Midwest Independent Transmission

System Operator and Southwest Power Pool, EER found

that wind projects are the most proposed form of generation,

comprising an average 80% of the total generation

seeking to interconnect. Wind development activity

across the US has prompted some planners to re-shape

transmission projects to include wind: at least four

of transmission projects profiled by EER were initially

targeted for coal generation and have been adapted

to address booming demand for wind power in the western

US.

Exhibit: US Wind Power 2008- 2020, Base Case vs

High Growth (Cumulative MW)

|

| Source: Emerging

Energy Research |

)

About the Findings

EER’s research findings were released in a Market

Brief, Transmission Initiatives Adapt to Wind US Growth,

part of the company’s North America Wind Advisory

Service, a program that provides on-going analysis

of market trends and developments to wind industry

developers, utilities, and technology suppliers.

EER’s US wind market forecasts appeared in our July

2008 release of US Wind Power Markets and Strategies

2008-2020, an in-depth study providing critical strategic

and tactical support for those seeking to compete

in US wind markets. This 310-page study, produced

annually by EER, features state by state analysis,

market environment rankings, competitive analysis

of utilities, IPPs and developers, as well as US wind

turbine manufacturer and component supplier analysis.

Follow this link for the study's Table of Contents

and Order Information.

About Emerging Energy Research

Emerging Energy Research is a leading industry

advisory firm providing unrivaled balance and perspective

on the world’s clean and renewable energy markets.

Based in Cambridge, MA and Barcelona, Spain, EER works

with more than 1,000 stakeholders across the industry,

providing research-based advice, support, and analysis

to executives and key decision-makers including utilities,

developers, independent power producers, technology

promoters, manufacturers, and investment companies.

|