Renewables Global Status Report

2009 Update

Sep 9, 2009 - Eric Martinot and

Janet Sawin - Renewable Energy World.Com

Future targets for renewable energy

now exist in over 73 countries, up from 45 in 2005.

Many such trends continue and are documented in

this summary of the REN21 annual report.

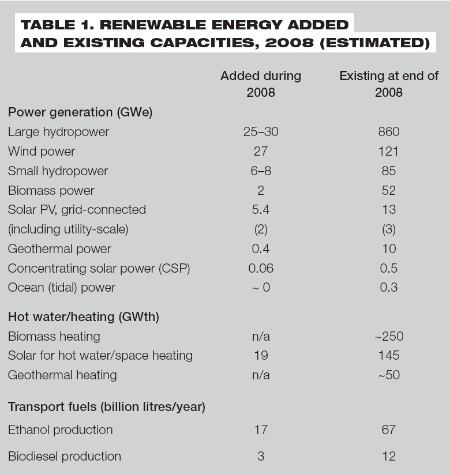

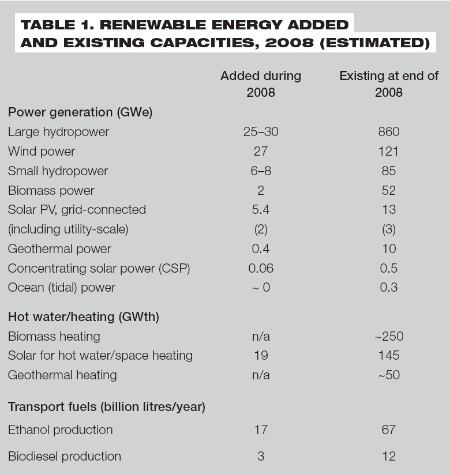

The year 2008 was the best yet for

renewables. Even though the global economic downturn

affected renewables in many ways starting in late

2008, the year was still one to remember. As Table

1, on page 22, shows, in just one year, the capacity

of utility-scale solar photovoltaic (PV) plants

(larger than 200 kW) tripled to 3 GW. All forms

of grid-tied solar PV grew by 70%. Wind power grew

by 29% and solar hot water increased by 15%. Annual

ethanol and biodiesel production both expanded by

34%. Heat and power from biomass and geothermal

sources continued to grow, and small hydro increased

by 8%.

The year 2008 also marked four years

of dramatic gains across all technologies. Looking

back, many can remember the milestone ‘Bonn Renewables

2004’ conference, which brought together delegates

from over 145 countries around the world to accelerate

global action. That year was also the genesis of

the REN21 Renewables Global Status Report.

|

| Rotors and blades are hoisted

at the Da Ban Cheng wind farm in the Xinjiang

province in China. The turbine was manufactured

by GoldWind. Photo Credit: LM Glasfiber |

Since then, the four-year period 2005–2008

saw gains unprecedented in the history of renewables:

grid-connected solar PV capacity increased six-fold

to 13 GW; wind power capacity increased 250% to

121 GW, and total power capacity from new renewables

increased 75% to 280 GW, including significant gains

in small hydro, geothermal, and biomass power generation.

Meanwhile, solar heating capacity doubled to 145

GWth; biodiesel production increased six-fold to

12 billion litres per year; ethanol production doubled

to 67 billion litres per year; and annual renewable

energy investment in new capacity increased four-fold,

to reach US$120 billion (€85 billion).

Perhaps one of the most remarkable

milestones for 2008 was that renewables represented

more than 50% of total added power capacity in both

the United States and Europe. That is, more new

renewables capacity was installed than new capacity

for gas, coal, oil, and nuclear combined – although

on a kWh basis, renewables’ added contribution is

less than capacity shares imply. By 2008, the top

six countries by total amount of renewable power

capacity were China (76 GW), the US (40 GW), Germany

(34 GW), Spain (22 GW), India (13 GW), and Japan

(8 GW). Capacity in developing countries grew to

119 GW, or 43% of the total.

The year was also remarkable for the

changes in country leadership of particular markets.

Germany, the global wind power leader since the

mid-1990s, ceded its position to the United States,

which added 8.4 GW in one year to reach 25 GW installed.

Germany was still close behind, at 24 GW installed,

followed by Spain, China, and India. China moved

from sixth to fourth place in 2008 as its wind power

capacity doubled for the fifth year in a row. China

added 6 GW and ended 2008 with more than 12 GW,

achieving its 2010 target of 10 GW two years early.

More than 80 countries around the world had commercial

wind power installations by 2008, with Mongolia

and Pakistan two of the most recent additions.

Existing offshore wind capacity

reached 1.5 GW in 2008, virtually all in Europe,

with 360 MW added in 2008. The United Kingdom became

the offshore wind power leader.

In grid-connected solar PV,

Spain became the clear market leader, with 2.6 GW

of new capacity added, representing half of 2008

global additions of 5.4 GW, and a five-fold increase

over the 550 MW added in Spain in 2007. However,

Spain is not expected to repeat the 2008 performance,

as its target was achieved and policy support has

been scaled back. Spain’s unprecedented surge surpassed

former PV leader Germany, which added 1.5 GW in

2008. Other leading markets were the United States

(310 MW added), South Korea (200–270 MW), Japan

(240 MW), and Italy (200–300 MW). Markets in Australia,

Canada, China, France, and India also continued

to grow. Globally, more than 16 GW of solar PV existed

by the end of 2008, including off-grid installations.

Spain also led a boom in utility-scale

solar PV power plants (defined as larger than

200 kW), which emerged in large numbers around the

world in 2008 – there were an estimated 1800 such

plants existing, up from 1000 in 2007. The majority

of utility-scale plants added in 2008 were in Spain,

with others in the Czech Republic, France, Germany,

Italy, Korea, Portugal, and the US. At 60 MW, the

Spanish Olmedilla de Alarcon plant, completed in

2008, became the world’s largest solar PV plant.

Several European countries also now lead a boom

in building-integrated PV (BIPV), which is a small

but rapidly growing segment of some markets. T

he United States remained the world

leader in geothermal power development, with

more than 120 projects under development, representing

at least 5 GW. Geothermal projects were under way

in over 40 countries, with another 3 GW in the pipeline.

Globally, geothermal power capacity reached over

10 GW in 2008.

Leadership in concentrating solar

thermal power plants (CSP) is now shared by

the United States and Spain. Two new CSP plants

came online in 2008 – the 50 MW Andasol-1 plant

in Spain and a 5 MW demonstration plant in California

– following three new plants in these two countries

during 2006–2007. A number of additional projects

are due to come on-line in 2009, including two more

50 MW plants in Spain and 20 MW of CSP integrated

with a 450 MW natural gas combined-cycle plant in

Morocco. The pipeline of projects under development

or construction increased dramatically during 2008,

to more than 8 GW by some estimates, with over 6

GW under development in the United States alone

(in five different states). New projects are also

under development in Abu Dhabi, Algeria, Egypt,

Israel, Italy, Portugal, Spain, and Morocco. One

important trend is that a growing number of these

future CSP plants will include thermal storage to

allow generation into the evening hours. The completed

Andasol-1 plant in Spain, for example, has more

than seven hours of full-load thermal storage capability.

|

|

Renewable

energy added and existing capabilities, 2008

(Estimated)

Photo Credit: REN21

|

In renewable heating technologies,

solar hot water made impressive gains. China accounted

for three-quarters of global added capacity in 2008

(14 GWth added in China out of 19 GWth globally).

Solar hot water in Germany set record growth in

2008, with over 200,000 systems installed for an

increase of 1.5 GWth in capacity. Spain also saw

rapid growth, and the rest of Europe besides Germany

added about 0.5 GWth of new capacity. Among developing

countries, Brazil, India, Mexico, Morocco, Tunisia,

and others saw an acceleration of solar hot water

installations.

In transport fuels, fuel ethanol

production in Brazil ramped up dramatically in 2008,

to 27 billion litres, after being fairly constant

for a number of years. And for the first time ever,

more than half of Brazil’s non-diesel vehicle fuel

consumption came from ethanol. Notwithstanding Brazil’s

achievement, the United States remained the leading

ethanol producer, with 34 billion litres produced

in 2008. Other countries producing fuel ethanol

include Australia, Canada, China, Colombia, Costa

Rica, Cuba, the Dominican Republic, France, Germany,

India, Jamaica, Malawi, Poland, South Africa, Spain,

Sweden, Thailand, and Zambia. The EU is responsible

for about two-thirds of world biodiesel production,

with Germany, France, Italy, and Spain the top EU

producers. By the end of 2008, EU biodiesel production

capacity reached 16 billion litres per year.

Investment Flows

Global investment flows to renewables

increased markedly in 2008, while at the same time,

country investment leadership changed hands. As

recently as 2006, Germany and China were the global

leaders in new capacity investment, with the United

States far behind. However, due to a massive surge

in wind power investment in the country, the US

became the global leader in 2008, with $24 billion

(€17 billion) invested, or some 20% of the global

total. Spain, China, and Germany were not far behind

the United States, all in the range of $15–19 billion

(€11–13.5 billion). Spain moved up to second place

by virtue of its large investments in solar PV.

Brazil was fifth overall, at $5 billion (€3.5 billion),

due to large investments in biofuels.

Globally, approximate technology shares

of the $120 billion (€85 billion) in new capacity

investment were wind power (42%), solar PV (32%),

biofuels (13%), biomass and geothermal power and

heat (6%), solar hot water (6%), and small hydropower

(5%).

New capacity investment includes investment

in new power plants, rooftop panels, and biofuels

refineries (also called ‘asset finance and projects’),

but does not include research and development funding

or new manufacturing plant and equipment for the

solar PV and wind industries. If these other categories

of investment are included, total investment in

2008 likely exceeded $140 billion (€99 billion).

[Note: A widely cited figure for 2008 by New Energy

Finance is $155 billion (€110 billion) in clean

energy investment, but that number includes further

categories; for clarification, see Endnote 13 in

the Renewables Global Status Report 2009 Update

and the UNEP/SEFI report Global Trends in Sustainable

Energy Investment 2009.]

Other indicators of investment flows

registered continued gains in 2008. For example,

private equity investment and venture capital flows

grew to $13.5 billion (€9.5 billion) in 2008, up

from $9.8 billion (€6.9 billion) in 2007. And, development

assistance for renewable investments in developing

countries reached about $2 billion (€1.4 billion)

in 2008, up from $500 million (€355 million) in

2004.

Of course, investment flows have been

affected by the financial crisis. Although the clean

energy sector initially weathered the crisis better

than many other sectors, renewable investment did

experience a downturn after September 2008. According

to New Energy Finance, total clean energy investment

in the second half of 2008 was down 23% from the

second half of 2007. Overall, renewable investments

did not escape the general flight from risk. However,

projects have continued to progress, particularly

those supported by policies such as feed-in tariffs.

|

| At 60 MW, the Spanish Olmedilla

de Alarcon plant, completed in 2008, became

the largest solar PV plant in the world. Photo

Credit: Nobesol Levante |

At the end of 2008 and in early 2009,

partly in response to the financial crisis, a number

of national governments announced plans to greatly

increase public finance of renewables and other

low-carbon or clean technologies. Many of these

announcements were directed at economic stimulus

and job creation, with millions of new ‘green jobs’

targeted.

Industry Trends

Renewable industries boomed during

most of 2008, with big increases in manufacturing

capacity and a diversification of locations. By

August 2008, at least 160 publicly traded renewable

energy companies each had a market capitalization

over $100 million (€71 million). The total market

capitalization of these companies, prior to the

late-2008 market crash, was more than $240 billion

(€170 billion). Of course, the market value of virtually

all companies then took a big hit, and many subsequently

closed plants, laid off workers, cut production,

and revised expansion plans. It is too early to

assess the full impacts, but anecdotal evidence

suggests that many renewable energy companies have

continued to do well in early 2009.

The solar PV industry continued to

be one of the world’s fastest-growing sectors in

2008. Global annual production increased six-fold

between 2004 and 2008, reaching 6.9 GW. China usurped

Japan to become the new world leader in PV cell

production (1.8 GW, not counting Taiwan), with Germany

moving up to second place (1.3 GW), followed by

Japan (1.2 GW), Taiwan (0.9 GW), and the United

States (0.4 GW). Although the US ranked fifth overall,

it led the world in thin-film production (270 MW),

followed by Malaysia (240 MW) and Germany (220 MW).

Globally, annual thin-film production increased

120% in 2008, to reach 950 MW, as thin-film technologies

met a larger share of demand.

The global solar PV industry ended

2008 with over 8 GW of cell manufacturing capacity,

including 1 GW of thin-film capacity. During 2008,

the industry announced additional major production

capacity expansions, many of them for thin-film

technology, although many plans were called into

question after the 2008 crash. Also during 2008,

India emerged as an aspiring producer of solar PV,

with state-level support for solar PV manufacturing

in special economic zones.

In the wind power industry, China

saw the greatest growth in 2008, with several new

companies producing turbines and many new component

manufacturers. The industry appeared poised to start

exporting turbines and had achieved a high level

of domestic sourcing for most components. By the

end of 2008, at least 15 Chinese companies were

commercially producing turbines and several dozen

more were producing components – the industry reportedly

grew to more than 70 manufacturing companies. The

Chinese wind sector appeared unaffected by the global

economic crisis, according to industry observers,

and some expect manufacturing capacity to approach

20 GW/year by 2010.

New wind turbine manufacturing facilities

opened in several other countries during 2008, notably

in the US, where the share of domestically manufactured

components rose from 30% in 2005 to 50% in 2007

and many new turbine and component manufacturing

facilities came on line. Companies in at least two

new developing countries, Egypt and Turkey, started

to manufacture megawatt-scale wind turbines for

the first time.

In other industry developments during

2008:

Concentrating solar (thermal) power (CSP) The

CSP industry saw many new entrants and new manufacturing

facilities, particularly in Germany, Spain, and

the United States.

Ethanol In the United States, 31 new ethanol refineries

came online, bringing total production capacity

to 40 billion litres/year, with additional capacity

of 8 billion litres/year under construction. In

Brazil, biofuels production expanded dramatically,

with over 400 ethanol mills and 60 biodiesel mills

operating. In Europe, more than 200 biodiesel production

facilities were operating, and additional ethanol

production capacity of over 3 billion litres/year

was under construction.

Cellulosic ethanol In the United States, plants

totalling 12 million litres/year were operational,

and additional capacity of 80 million litres/year

was under construction. In Canada, capacity of 6

million litres/year was operational. In Europe,

plants were operational in Germany, Spain, and Sweden,

and a capacity of 10 million litres/year was under

construction.

Targets for Renewable Energy

|

|

The 50 MW Andasol-1 CSP plant

in Spain nearing completion in 2008

Photo Credit: Floba40/

Panoramio.com

|

By early 2009, policy targets for

renewable energy existed in at least 73 countries

and states. This includes state/provincial-level

targets in the United States and Canada, which have

no national targets to date. In addition, there

is an EU-wide target of 20% of final energy consumption

by 2020 that was enacted in 2007. That EU-wide target

was followed in 2008 by final confirmation of 2020

targets for all 27 individual EU member countries.

Some EU countries also adopted additional or supplementary

targets in 2008, such as Germany’s targets for 30%

electricity and 14% heating by 2020. Also, an existing

EU transport-sector target (10% share of transport

energy by 2020) was modified to encompass biofuels,

electric vehicles, and electric trains, with a credit

multiplier of 2.5 for renewable electricity consumed

by electric vehicles. Special provisions for biofuels

sustainability were also adopted.

Many policy targets were enacted or

upgraded during 2008 in jurisdictions around the

world. (For country-by-country target details, see

the 2007 and 2009 editions of the Renewables Global

Status Report.) At the national level, new targets

were enacted or upgraded in Abu Dhabi/UAE, Albania,

Australia, Bangladesh, Brazil, Cape Verde, France,

India, Indonesia, Ireland, Israel, Jamaica, Kenya,

Madagascar, Nicaragua, Pakistan, Russia, Rwanda,

Samoa, South Korea, and Tunisia. At other levels,

targets were enacted or upgraded in several states/provinces

in the United States and Canada, Chinese Taipei

(Taiwan), Scotland (UK), and Gujarat (India), among

others.

Although not strictly a target, China’s

plan to go beyond its existing goal of 30 GW of

wind power by 2020 is noteworthy. China is planning

new large-scale ‘wind power bases’ in six provinces/regions

that could result in 100 GW of new wind capacity

by 2020. According to one analysis, China’s 2007

renewable mandates for power generators – requiring

8% of capacity and 3% of generation by 2020 – also

imply an additional 100 GW of non-hydro renewable

capacity by 2020.

During 2007–2008, a number of countries

exceeded existing targets for 2010, including China

(10 GW of wind capacity target), Germany (electricity

target), Hungary (electricity target), and Spain

(solar PV target).

Policies To Promote Renewables

By early 2009, at least 64 countries

had some type of policy to promote renewable power

generation. Feed-in tariffs are the most widely

used policy, existing in at least 45 countries and

18 states/provinces/territories around the world.

Feed-in tariffs were adopted at the national level

in at least five countries for the first time in

2008 and early 2009, including Kenya, the Philippines,

Poland, South Africa, and the Ukraine. Following

its earlier feed-in policies developed in the 1990s,

India also adopted new feed-in tariffs for solar

PV and solar thermal power. Several more countries

were engaged in developing feed-in policies, including

Egypt, Israel, Japan, Nigeria, and the United Kingdom.

At the state/provincial level, at least 10 jurisdictions

adopted new feed-in tariffs in 2008 and early 2009.

Several countries also revised or supplemented their

feed-in laws. Common revisions included extending

feed-in periods, modifying tariff levels, adjusting

annual percentage decreases in tariffs, establishing

or removing annual programme capacity caps, adding

eligibility for (distributed) micro-generation (including

small-scale wind power), and modifying administrative

procedures.

Other policy developments for 2008

and early 2009 include:

Three US states and two countries adopted renewable

portfolio policies, bringing to 49 the total number

of countries, states, and provinces worldwide with

RPS. At the national level, new RPS policies were

adopted in Chile and India.

New or expanded solar PV promotion programmes

continued to appear at the national, state/provincial,

and local levels. Significant was the opening of

the grid-connected solar PV market in China with

a new subsidy policy for building-integrated PV.

Many other jurisdictions also enacted new solar

PV subsidies.

In the United States, the production tax credit

was extended through 2012–2013 and the investment

tax credit was extended to 2016.

Many other forms of government support for renewable

power generation continued to expand, including

licensing, net metering provisions, and investment

subsidies.

Comprehensive new renewable energy laws were enacted

in several developing countries, including Chile,

Egypt, Mexico, and the Philippines, while existing

laws were extended or strengthened in Brazil, China,

India, and Uganda.

Mandates for solar and other renewable hot water/space

heating in new building construction greatly accelerated.

Examples can now be found in Germany, Israel, Norway,

Spain, and Syria, in the German state of Baden-Württemberg

and the US state of Hawaii, in dozens of cities

in Spain, and in the cities of Cape Town and New

Delhi, among others.

Much more policy attention is being paid to renewable

heating than in previous years, with new subsidies,

tax incentives, consumer loan programmes, and technical

standards.

There were a total of 55 states/provinces/countries

with mandates to blend biofuels with conventional

gasoline and/or diesel. A number of countries continued

to adjust price regulation, modified tax incentives,

or adjusted targets.

Green power markets grew strongly, and the number

of green power consumers worldwide grew to over

5 million households and businesses, primarily in

Australia, Germany, Japan, the Netherlands, Sweden,

Switzerland, and the United States.

City and local government policies for renewable

energy are a diverse and growing segment. Hundreds

of local governments are setting future targets,

adopting a broad array of planning and promotion

policies, including new local feed-in tariffs and

renewable heating mandates for buildings. (A draft

REN21 report on this topic is now available at www.martinot.info/cities.htm,

with further updates coming.)

Conclusion

The integrated picture of global renewable

energy markets, investment, industry, and policies

presented here provides much for optimism about

the future. Indeed, the modern renewable energy

industry has been hailed by many analysts as a ‘guaranteed

growth’ sector, due to the global trends and drivers

underlying its expansion during the past decade.

Policy makers have reacted to rising

concerns about climate change and energy security

by creating more favourable policy and economic

frameworks, while capital markets have provided

ample finance. The recent growth of the sector has

surpassed all predictions, even those made by the

industry itself. Without a doubt, the renewable

energy sector has felt the impact of the current

economic crisis, but growth continues. The Renewables

Global Status Report shows that the fundamental

transition of the world’s energy markets is continuing.

Eric Martinot is Senior Research

Director of the Institute for Sustainable Energy

Policies in Tokyo, research fellow of the Worldwatch

Institute, and affiliate of the Tsinghua-BP Clean

Energy Center of Tsinghua University. Janet Sawin

is Senior Researcher and Director of the Energy

and Climate Change Program of the Worldwatch Institute

and research director/lead author for REN21.

This article is based on the REN21

Renewables Global Status Report 2009 Update, written

by lead authors Eric Martinot and Janet Sawin, and

published in May 2009. Free downloads are available

at www.ren21.net and www.martinot.info. The authors

wish to thank the 150 researchers and contributors

who have provided information since 2004, the German

government for primary funding and the US government

for supplemental funding. And recognition of the

Worldwatch Institute is due for its leadership in

producing the report since 2005.