|

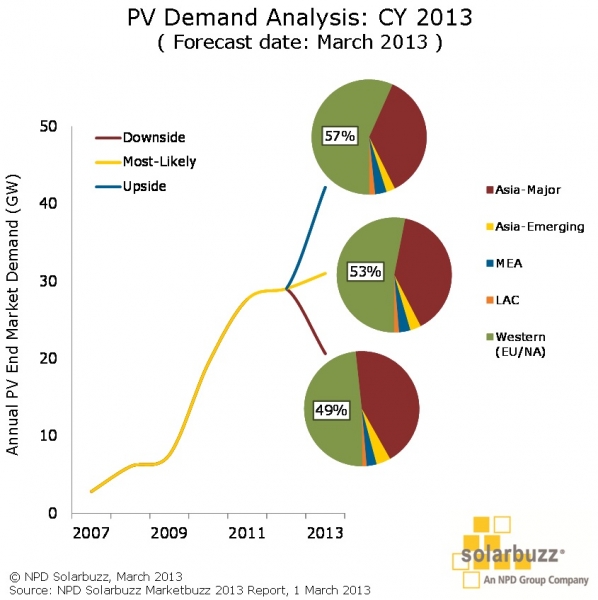

| NPD Solarbuzz forecast scenarios for PV demand during 2013 highlighting the dependency on existing Western PV markets, adapted from March 2013 Marketbuzz Report. |

European PV demand will be the key swing factor for final global PV demand during 2013. Sound familiar? Demand from established ‘Western’ PV territories (Europe and North America) may comprise as little as 49% of global demand, but as much as 57%. Whether we end up closer to the upper end of this range or the lower range will ultimately shape the outcome of the PV industry this year.

Much attention is centred today on a strong uptick in PV demand from emerging regions across the Middle East, Africa and Latin America and modest year-on-year growth from the US, Japan, China or India. However, from a risk perspective, European PV scenarios trump all other ‘upside’ and ‘downside’ projections. Throw in a trade war on imported modules from China, a scattering of political electioneering and further fiscal austerity measures, and Europe is likely to dominate PV demand forecasting once again this year.

Like it or not, but PV demand still has no generic global driving factor. Even with the current system pricing levels, global PV demand remains simply the accumulation of all the discrete countries that have policies or long-term renewable targets that are favourable to PV adoption.

Globalisation of demand is certainly embedded in the PV industry today. But this is more related to the number of countries offering served markets for the supply chains. In fact, the days of tracking a dozen or so countries and lumping in a top-down ‘guess’ for the contributions from any random Rest-of-the-World grouping is no longer acceptable or of any great use.

Therefore, in examining any data on forecasted PV demand, the key is diving into the detail - not taking the top-line number at face value. Indeed, to fully grasp the contents, it is further necessary to break down the detail at the country (or state) level by quarter, and by application segment: how much is residential by quarter in each country? How much is ground-mount? How much is utility driven, etc?

During 2013, 25 different countries are projected to have >100MW of PV demand, when 'most-likely' forecasting scenarios are assumed in each of these countries. According to detailed analysis featured in the new NPD Solarbuzz Marketbuzz Report, this creates the global most-likely demand figure of 31GW. No mysterious global over-viewing is factored in, and no hopeful contributions from Rest-of-the-World categories appear as an upside. Decreasing the filter by a further order of magnitude and the number of countries necessary to track starts to approach 100.

The detail behind the single number for global demand is simply essential today, and will become more critical over the next five years. This is because any global figure is simply a summation of the micro supply/demand environments that exist at the country level. For example, any individual supplier only has a subset of countries and application segments that can realistically be targeted. Further, the downstream channels typically focus at the country or state level or confine their global aspirations to specific regions where access-to-market is considered viable.

In addition, softness in one country or region does not by default imply that any slack is going to be picked up elsewhere. The lessons of 2012 stand as a harsh reminder of this theme. While many suppliers clung to the hope that PV demand would reach the mid-30GW level or even the high 30s during 2012, much of this was on the basis of China consuming up to 6-7GW last year or there being some kind of downstream ‘learning curve’ that said that PV demand could only grow by strong double-digit year-on-year factors. PV demand ended up at 29GW during 2012.

Returning to 2013, we see that by adding up every global PV country using the most-likely scenario, we get to 31GW. And as noted above, there is no magic global grid-parity multiplier that can be applied to a nameless Rest-of-the-World grouping. Even though pricing and the cost competiveness of solar PV is better than ever, almost every policy or incentive driving PV demand has been readjusted to reflect a new set of economics at play in every country.

PV specific incentives, renewable energy targets, prioritising solar PV over other renewable energy types and the willingness of dominant utility suppliers remain the key issues at every country level. And as such, every country still has a specific upside and downside range that reflects risk levels in each country that are typically beyond the control of most PV industry participants.

The net effect of all countries analysed can be seen in the graphic shown. For clarity here, we have grouped countries into a few categories: Asia Major (China, India, Japan and Australia), Asia Emerging (all other countries across Asia excluding the Major listing), Middle-East and Africa, Latin America and the Caribbean, and Western (Europe and North America). The three categories (Asia Emerging, MEA and LAC) comprise the ‘emerging’ group of the PV industry today.

The most-likely figure of 31GW stands as the benchmark demand figure for 2013. The 'downside' represents the worse-case scenario. While this is certainly less likely, having this reference point is still essential when looking at supply/demand outcomes. Equally so, the 'upside' figure can be seen as the optimistic bet, where every country hits its upside scenario forecast. But again, having purely an optimistic outlook on PV demand is a particularly dangerous proposition, given the way 2012 backfired on the supply side of the industry.

Upside and downside projections from Europe are likely to determine whether 2013 approaches the highs and lows of scenario forecasts. And this is coming from a policy perspective only. Trade-based ramifications may not fully affect Europe until 2014, and the permutations are numerous depending on the scope of any tariffs (level of tariff, but more importantly scope). Placing a punitive duty on module assembly forces a simple workaround, and is likely to drive new Asian manufacturing in Europe (great for local job creation: not great for indigenous manufacturing). Extending to cells or wafers would be a problem, considering that by 2014 the number of upstream c-Si manufacturers in Europe will be inadequate to supply any meaningful European demand.

Therefore, like it or not, PV industry demand forecasting remains dominated by country-specific risks. And anyone looking for confirmation of this only needs to look at Spain or the Czech Republic, or the new forecasts for Germany and Italy. In fact, given the dire financial state of most PV industry participants today, it is perhaps somewhat irresponsible to cling onto altruistic global grid-parity growth drivers. Commercial reality wins every time, and in this regard, only low-risk, country-specific opportunities should form the basis of near-term revenues.

First quarter forecasts for the calendar year start off with the largest range between downside and upside. During the year, the range gets narrowed as policies become clearer and exactly how they will impact at the country level. Similarly, the most-likely figure will be revised as the year unfolds.

However, what is more relevant today is how this affects individual companies. For example, every company (in the supply or demand side) has a country and application specific served addressable market (SAM). Performing exactly this type of scenario forecasting by filtering out SAMs then provides the bounds under which any sales and marketing department can be accounted for. And similarly, it enables SAM market-share metrics to be tracked – something that is far more valuable than looking at market-share calculations based on global TAMs. Indeed, the global situation could appear worse, but the SAM for individual suppliers could in fact increase if they are aligned with the high growth segments.

In three months from now, NPD Solarbuzz will publish its next bottom-up global end-market demand analysis, factoring in over 100 countries’ contributions at the quarterly application segment level. At this point, direct comparison to the graphic shown here will offer an indication of how the PV industry has been affected by PV adoption criteria at the global level.