Milestone: 10 Gigawatts of PV in 2010, Part 1

Jun 11, 2010 - Eric Wesoff- greentechmedia.com

As we approach the upcoming autumn milestone of 10 gigawatts of solar installed in 2010, Greentech Media asks a few solar luminaries to reflect on the event.

In 2010, we will cross the threshold of 10 gigawatts of photovoltaic solar installed globally in a single year -- a record-setting and once-inconceivable number.

Rewind to ten years ago: the total amount of photovoltaics installed in the year 2000 was 170 megawatts. Since then, the solar photovoltaic industry has grown at a 51 percent annual growth rate, and 170 megawatts is now the size of a healthy utility installation or a small solar factory. As Andrew Beebe mentions below, Suntech has a single building with a one-gigawatt capacity.

Photovoltaic module pricing has made radical progress, as well, moving from $300 per watt in 1956, to $50 per watt in the 1970s, to $10 per watt in the 1990s, to $2 per watt today. It's not exactly Moore's law, but it is that drop in pricing, chicken-or-egg with policy and technology, that is driving this industry. Pricing of $1 per watt is not that far off.

Ten gigawatts is a significant milestone for the PV industry, but it warrants some perspective:

- That's the total power that five or six nuclear power plants generate -- and there are about one hundred nuclear plants in the U.S alone.

- The wind industry installed 27 gigawatts in 2008, 38 gigawatts in 2009 and has a total installed base of more than 158 gigawatts compared to PV's installed base of about 20 gigawatts. 2010 will see more than 200 gigawatts of installed wind and the Global Wind Energy Council expects that to double to 400 gigawatts by the end of 2014.

A few more points about today's PV market: From a demand standpoint, it's healthier, with less reliance on "savior" markets and feed-in tariff hotspots. Note the diminishing reliance on Germany as solar savior in the chart below and get many more details in Shayle Kann's recent PV demand analysis.

From a supply standpoint, the market is less healthy -- over-supplied and ripe for consolidation.

Still, the 10-gigawatt-PV-installed mark will occur, barring disaster, sometime in October. Our calculations put it at 2:15 PM on October 13. It's a milestone worth noting and a stepping stone, as Travis Bradford and Jeff Wolfe note below, on the way to 100 gigawatts installed in 2020.

Here are some reflections on the achievement from some of the technologists, entrepreneurs and investors making it happen:

Dan Shugar, CEO Solaria Corporation

In 2004, we built the world's first 10-megawatt PV project at PowerLight Corporation -- Bavaria Solar 1. Constructed in six months with investment-grade financing, this project exceeded performance expectations. That project and many others like it have validated PV as reliable power-plant technology. In 2004, total shipments were 1 gigawatt; since then our industry has scaled 10X. No other energy technology has ever grown this rapidly. Costs for high-quality crystalline tracking PV have fallen by half over this period, while fossil-fuel-generating sources like coal have increased in cost over 70 percent; in sunny areas, PV is less costly today than energy from "gas peaker" plants, which is the best "apples to apples" comparison to PV.

In the U.S. over this six-year period, the Sierra Club and its allies have thankfully killed over half of all new proposed coal projects. The environmentalism momentum -- combined with recent catastrophes in fossil fuel extraction -- will further accelerate a transition to solar. I believe we have passed the "PV tipping point" and must now rally our efforts to accelerate PV's role as a mainstream energy source. Solaria Corporation, and other innovative companies, have developed new PV products that further reduce PV cost and significantly improve the rate of return on invested capital for new manufacturing capacity. It is very exciting to be part of this industry as we scale environmentally responsible solutions for meeting growing energy requirements, all while growing green-collar jobs and improving energy security.

Paul Detering, CEO Tioga Energy

As I thought about 2006 and 2007 (when I got started in solar) and what has happened in the past three years, it all pales in comparison to what must happen if distributed solar PV is to be another transformative, innovation-driven industry like personal computing, mobile communications, the internet, etc.

Yes, 10 gigawatts is a milestone. But it is not even the first lap of a long race. The worldwide installed electricity capacity in 2006 was about 4,000 gigawatts.

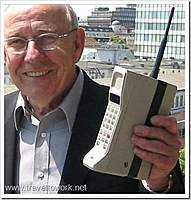

Today solar is where the Motorola brick was in 1983 -- 27 years ago. We must innovate the technology, infrastructure (network) and business systems in the same way the mobile communications industry has, achieving the same relative improvements and getting us to our solar iPhone (or solar Droid)

10 gigawatts represents about $50B of power generating capacity -- that is remarkable. Subsidies in one way, shape or form paid or will pay for about half of that. We need to take our solar bricks and create solar iPhones (or solar Droids) and wean ourselves off the subsidies. We need to do that before we get to 100GW or we will never get to the 1,000GW mark.

Andrew Beebe, Vice President, Global Product Strategy

Suntech Power

We have a building (that's one building!) in China that this year should be capable of cranking out one gigawatt of product per year. I think that's larger than the entire industry's capacity ten years ago. So, I'd say, yes, we've come a long way.

I think the other interesting statistic is: what percentage that 10 gigawatts is of all new global power generation capacity that's come online in the same year (much more interesting than the percentage of total global energy production for the year). Even more interesting is the percentage of new generation capacity produced in the last year, with production initiated in the last year. In other words, while nukes are interesting, their two-gigawatt reactors take 17 years to build, while we can go from sand to power generation in 12 months.

So, yes, we've come a long way.

I'm proud of the industry's capacity, but I think you will see anxiety and a lack of sleep in the eyes of everyone in the industry until we hit true grid parity in large regions of the world. In California, we're damn close. With the federal tax credit, and the small amount left in the CSI, residential buyers are finding that leasing and PACE and PPA options all make the economics work. This is great, but until we see this happen without those support mechanisms, we'll still have to live with inorganic growth driven by policy.

I predict that within three years, we'll see grid parity in parts of CA, Japan, and parts of Europe. Then the real fun begins.

Travis Bradford, Founder of the Prometheus Institute

Author of Solar Revolution

When I first started talking about the "Solar Revolution" in 2003, there was little interest or confidence that solar would ever matter. Despite almost 30 years of double-digit annual growth at that point, most folks neither saw the unfolding changes nor were willing to extrapolate those into the future. Now we are at the doorway of 10 gigawatts of annual production, grid parity in a diversified set of national markets around the world, and an awakening of the inevitable role solar will play in our future.

When my book came out in 2006, I would give talks that suggested that it would probably take 30 years for solar to become a dominant part of our energy asset base and 10 years to become a meaningful part of our annual new additions, but that we would likely see the most important achievement of what I termed "economic obviousness" -- the point at which the expectation of solar's eventual economic dominance was widely recognized -- within five years. Given that installed commercial and industrial system prices will fall below $3 per watt by the end of next year and electricity prices are rising faster than predicted, it seems like we are right on schedule.

Ten gigawatts of annual installation will not even be a footnote when the history of solar is written, but it is likely that 100 gigawatts will. I look forward to that milestone at the turn of the next decade, if not sooner. Viva la revolución.

Julie Blunden, EVP for Public Policy and Corporate Communications

SunPower

Julie Blunden at SunPower made the point that as an industry with 20 gigawatts of cumulative installed product, to build 50 percent of that figure in 2010 indicates that "our growth trajectory continues to be awe-inspiring." Blunden also pointed out that many nuclear and coal plants will have to be retired in the next decade. "What replaces them?" she asked. She sees solar as a credible replacement for those retired plants. But she cautions that going from 20 gigawatts to 100 gigawatts of cumulative installed photovoltaics will require a different approach than the first 20 gigawatts. "We have to do things really differently," she said, adding, "We must become world-class manufacturers."

Lyndon Rive, CEO

SolarCity

As an industry, we're still at the beginning of what we can accomplish. According to NREL, there are 73,000 solar electric installations in the U.S. today, and yet there are tens of millions of empty rooftops that could be generating power. I fully expect solar power to be the largest source of new U.S. electricity in the next decade.

Dan Adler, President CalCEF

Solar PV provided a useful introduction to private capital formation behind clean energy technology: it looked familiar technically, exhibited potential for scale economies, and most importantly, it seemed to promise direct access to a broad range of customers, which VC investors need. Solar PV will play a significant role in solving the climate and energy problem. But these dynamics had the unfortunate effect of convincing investors that they understood the energy industry and its unique political and regulatory burdens, and that the venture model on its own would yield a sustainable financing solution for clean energy technologies. Neither of these theories has proven true, and it remains to be seen whether these lessons have been internalized by our industry.

Jeff Wolfe, CEO

groSolar

When we started in 1998, 10 gigawatts was not even a dream. We spoke in kilowatts. After we hired our first full-time sales person in 2005 (Bob Lewis, a real professional), we used to joke that someday we'd talk in megawatts (and then laughed, because we just had).

Before solar, I was a consulting engineer, and I designed hospitals and laboratory facilities. A rough calculation indicated that the buildings I was involved with would take about 100 megawatts of solar to operate year-round. So that was what my 'super stretch goal' became. I thought that if I could install that in a long career, well, I'd be way off the charts. Now, not only does it look like groSolar will hit that mark, sooner rather than later (2011? 2012?), that goal is no longer crazy or unimaginable.

It is heartening to me to be part of the broad leadership that is moving us toward a solar future. It is also frustrating that we are only now reaching the 10 gigawatt mark, and that we still are not seeing, especially in the U.S., the groundswell in cultural perception needed to truly transform the industry, and thus the energy industry, and thus the world. OK, it is a big job, but naiveté has gotten me this far!

Of course, when we get to the 10-gigawatt mark, I'll need to remember to say "Yay!" When we were a young company, we used to celebrate every single kilowatt sale, every half-kilowatt sale. A 3-kilowatt sale would give us at least part of the afternoon off. Now, we sell a megawatt project and I try to send a brief email to let others know about it.

As we move into gigawatts, it appears that the ball is getting bigger, and the hill steeper. I am looking forward to the day when the slope levels out, but I doubt it will come very soon. This is my way of saying, celebrate the success, but don't rest on the laurels for one second. Unlike many industries, there are those who would happily see us fail, and would gladly assist us in failing.

Let's develop a new goal for the industry. Is it 100 gigawatts by 2020? Seems too low, as that would be less than 10 gigawatts per year. So is it 1000 gigawatts by 2020? That's less than doubling each year, but still impressive. (But is it beyond the speed of transformative events?) Don't set it too low; we need solar to hit stretch goals, because that's where solar solves some problems. Below that, it's just a nice side industry.

Joseph Brakohiapa, CEO Clean Power Finance

When I joined CPF in mid-2007 as a co-founder, Solar City was writing the book in the residential space, with everyone else trying to keep up. Their ability to deliver a lease product in early 2008 was groundbreaking and drove a nice growth spurt until Morgan Stanley blew up. Solar City continues to be on the leading edge, though tax equity is still tough to nail down, especially in residential and small commercial.

The biggest change I see is the emergence of new players in the solar space. Roofing and electrical distribution businesses have been making early inroads to solar. As the leading platform provider to the solar industry, we see daily evidence of this with regional players taking advantage of exiting distribution relationships, a captive network of trade professionals, and large customer bases with roofs to retrofit. Also, it's clear the long-tail installer at the local level is a key growth component in the residential space. From 2008, the top 10 companies lost market share in 2009, though the market grew. The difference is the long-tail small businesses migrating from other trades, notably, roofing and electrical contracting. With housing still down and 20 percent unemployment, renewables are a good bet for many of the trades looking for growth opportunities. As PACE programs emerge here in California, we may see a pop in Q4, but roll-outs in California are already behind schedule, so it will be 2011 until we see any real traction there.

Traditional module manufactures are experiencing shortages due in part to the German feed-in tariff step change. By Q3, this will likely be fixed, but the uncertainty of the federal grant going into 2010 will definitely be an issue. In 2008, many jobs were held back because there wasn't enough time to get them into service before year's end. Then in Q1 of 2009, there was a big surge as the ITC was renewed. There was even a shortage then, but we still grew at nearly 40 percent. It would be great if the feds can deliver the good news with a program robust enough to drive longer-term visibility and certainty for financiers.

Going forward, financing will still be the largest barrier to adoption in residential and small commercial. Large commercial and utility will find tax equity money, as things are rumored to be loosening up. With luck, residential will see some of this and drive not only rooftop installations, but jobs growth, as well. Clean Power Finance is committed to driving adoption through delivery of enabling tools for current solar players but especially new market entrants. With 130 million owner-occupied homes, there is plenty of head room for everyone. Better liquidity and more robust policy will be a big determinant of the United States' ability to achieve the adoption rates of countries like Germany.

Dave Pearce, CEO

NuvoSun

I formed MiaSolé in 2001 as a restart of a company I had formed in 1999 to focus on thin-film optical components for fiber optic communications. As the optical market continued to implode, I found a buyer for the telecommunications portion of the business and then looked around for what else to do with our thin-film sputtering tools and process experience. We had been late to the party for optical components and did not want to repeat this situation. My CTO since 1987, Dennis Hollars, was an astrophysicist by training and had pushed me for years to look at thin-film solar. By late 2002, the market was still quite small but was growing over 40 percent per year. It appeared we might have a chance to be an early entrant into another potentially high-growth market. 2002 and 2003 were very challenging years for raising money after the dotcom bust, so I found myself financing the first $1.5 million of investment in MiaSolé. DFJ’s investment in Konarka led some VCs to wonder whether they were missing something, but still, it was nearly impossible to get a term sheet. Scheduling VC meetings was relatively easy, as many were trying to educate themselves on the solar market. By mid-2003, VantagePoint had told us they would invest if we could demonstrate a 10-percent solar cell using our planned sputtering process. (Konarka never would have been funded had this been the criteria.) By December 2003 we had demonstrated 11.8 percent efficiency on a glass substrate and quickly closed on our first round of venture financing in February 2004. By 2005, the solar market had continued to grow at a rapid rate, as had VC interest in thin-film solar. In mid-2005, we found ourselves in the middle of a bakeoff between Mohr Davidow and KPCB and ultimately chose Kleiner, with the proviso that John Doerr would join the board. 2006 was an even hotter investment climate. I remember the first new investor I talked to for what was going to be MiaSolé’s Series D round. At the end of our two-hour meeting, they asked what the valuation was. The only guidance I offered was that I heard Nanosolar had gotten close to a $300 million valuation and I felt MiaSolé was further along. That afternoon I got a term sheet for a $10 million investment at a $300 million pre-money valuation. The next day I had my second VC meeting and quickly got a term sheet for $10 million at a $350 million valuation. Start to finish, this round took less than 30 days to close on $50 million. The market continued strong and peaked in the summer of 2008 with billion-dollar valuations for several pre-revenue thin-film solar companies. Of course, First Solar had gone public by then with a market value approaching $25 billion. Clearly, over the five-year period, solar investing had come into vogue with a vengeance.

The engineering team at MiaSolé had significant thin-film experience from our years in optical components and hard disks, and felt we had a clear path to commercialization. Scaling proved far more difficult in terms of everything from vendors' ability to make sputtering targets to conventional gridline application techniques that would short the cells out. The learning curve was steep, but then again, we didn’t know what we didn’t know. Every time the equipment tool set changed (R&D, pilot line, production line, etc.), major portions of the process had to be modified. Virtually all of the thin-film solar startups were in the same boat. CIGS proved to be a very complex material and the reaction pathways were very difficult to figure out. While MiaSolé has finally transitioned to commercial production, others of the same era still struggle with their processes. Some undoubtedly will not cross the finish line.

I had spent 17 years in data storage before getting into the CIGS business. I will never forget my first two SEIA-sponsored solar conferences. The first one was at the Hyatt in San Francisco. The attendance was very modest and was made up of what appeared to be mostly “tree huggers” and representatives from PG&E. The next year, the conference was held in Washington D.C. (perhaps it was two years later). I remember going to a SEIA board meeting and being surprised by the two main topics of conversation: (1) The crystalline silicon guys patting themselves on the back because they had achieved grid parity based on a new DOE model and (2) the near-obsession with how to get more government funding. In my previous 30 years of business experience, I had never worked in a field that received direct government grants. Data storage and optical components were as competitive as markets could be and were not supported by subsidies. I remember walking over to one of the capitol buildings with a group of solar executives thinking that no one had a viable business without a government handout. I have since come to appreciate the value of early government support for the solar market, but my focus was always on how to become the lowest-cost producer, as subsidized markets can’t last forever.

Other early impressions: The industry technology leaders were largely made up of academic types in the early 2000s. The industry had not yet attracted many experienced managers and engineering talent from more mature industries. It was like the Wild West. As the funding increased and the industry continued its rapid growth, there was a transformation of talent coming into the solar industry. The maturing of the industry and increased professionalism has been interesting to watch. By 2007, having an NREL scientist on your team was no longer the ticket to VC funding. While private investment was accelerating by 2006, the DOE also started playing a more active role with the SAI in 2006-2007, and ITC benefits for solar installations were implemented soon thereafter. I remember one customer offering me a $50 million purchase order in 2006 when I had not even delivered a sample; I refused. Getting orders was like shooting ducks in a pond. DayStar, as I recall, had nearly a billion dollars in announced contracts but to this day has still never produced a commercial module. From a personal standpoint, I clearly over-committed and under-delivered, and would likely still be at MiaSolé if this had not been the case, but I was far from alone. Scaling always seemed like it was right around the corner. Even after a scalable solar cell process was figured out, there were a lot of lessons to be learned on how to develop a module assembly process. This added another 12 months to MiaSolé’s schedule after I left in late 2007. I also remember being under near-constant pressure from the venture investor board to hire more resources, partly due to the VCs' belief in the “first mover” advantage. In hindsight, I think the additional resources had only a minor effect on the gestation period required to give birth to a new process. Process businesses are much harder to predict than, say, designing a product or writing software code. It was deceivingly simple to follow the NREL process for very small CIGS devices, but it proved universally difficult to scale.

10 gigawatts per year is a big deal, but in 6 to 7 years, we could be looking at 100 gigawatts per year. A $1-per-watt module price is the next big target, followed by a $2-per-watt installed system price. Today, some of my team was reminiscing about the early disk drive industry, where the first IBM PC had a 10-megabyte drive, which they bought in OEM quantities for $450. In the Mercury News this morning was an ad for a 1.5 terrabyte drive for $88 retail, 27 years later. Solar is still a very young market with many milestones yet to come.

|