Report: Central American Solar Markets Spurred On by High Electricity Prices

Jul 23, 2013 - Nicholas Rinaldi - greentechsolar

GTM Research publishes a new report on growth in unsubsidized Central American PV markets.

On the surface, Central America seems ripe for solar development. All seven countries -- Belize, Costa Rica, El Salvador, Nicaragua, Honduras, Panama, and Guatemala -- enjoy significant solar resources and nearly all are heavily reliant on thermal generation (primarily fuel oil and diesel) and hydroelectric resources, which can prove fickle in warmer months. With limited domestic fossil fuel resources, the cost of generation is typically very expensive in many of these countries.

However, as explored in a new report from GTM Research, differences in electricity market structure, available incentives, and local economies significantly affect whether or not PV is a tenable option for residential, commercial, and utility customers. The report also explores whether it is realistic to expect solar market growth in this region in the near future.

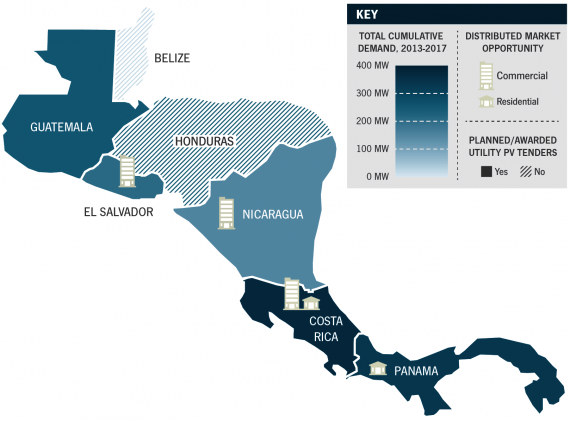

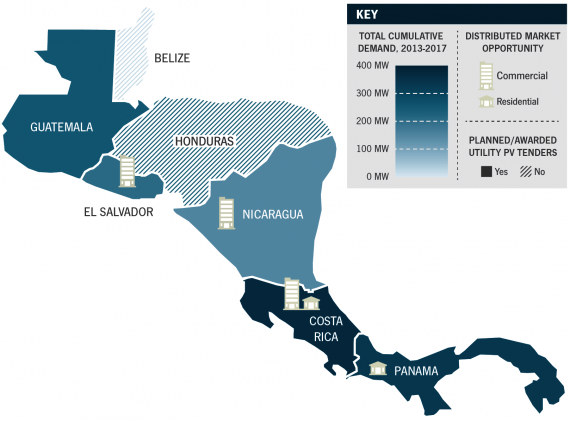

There have been a number of large-scale project announcements to come out of the region recently. Guatemala awarded two large-scale tenders for a total of 55 megawatts, and Costa Rica received a loan of US$30 million from the Chinese government for the construction of a 10-megawatt PV facility. Following a similar trend to other Latin American projects, this first round of large-scale PV development will likely be financed by national development banks and will not reach completion for a few more years. However, there is also opportunity in distributed PV markets in a number of countries.

Costa Rica and Panama (in addition to Nicaragua) already offer net metering to residential and commercial electricity customers, and electricity rates are high enough in these two countries such that residential systems have attractive payback periods. However, even without net metering there are opportunities for distributed development, particularly with commercial and industrial electricity consumers. In some countries, including Honduras and El Salvador, commercial entities with seven-day load could achieve significant discounts to retail rates. Similar unsubsidized systems have already been installed in other global markets, including Spain.

FIGURE: Near-Term Growth Opportunities in Central America

Source: PV in Central America: Markets, Competitive Positioning and Outlook, 2013-2017

Like other emerging markets, the availability of financing remains a major hurdle to market growth. For large-scale projects, funds are likely to come from national development banks, though with this capital typically comes stipulations for components or EPC duties of the same national origin. On the distributed side, a majority of early adopters will likely purchase systems outright. One such instance is the InterContinental Hotel in San Salvador, El Salvador. The hotel’s owner, Real Hotels and Resorts, purchased a 21-kilowatt array outright that was designed and built by THiNKnrg of Latin America. Though net metering is not available, this PV array, coupled with a solar thermal system, has an anticipated payback period of just five years.

As many Central America countries look to contract additional generation resources and provide increased electrification to citizens, PV has an increasingly important role to play. In this latest report from GTM Research, we identify near- and long-term opportunities and which national markets are most conducive to all forms of PV development. Included in the report are forecasts by country and market segment, as well as an in-depth look at country-specific electricity market dynamics and active solar developers.

Tags: belize, central america, costa rica, el salvador, gtm research, guatemala, honduras, nicaragua, panama, pv, solar

|