IHS: Mexico joins South Africa and Turkey in top three emerging PV markets

Mar 12, 2014 - Andy Colthrope - PV-tech.org Several hundred megawatts of PV projects currently under construction in Mexico are driving the country to third place in the world for attractiveness to investors, developers and manufacturers in the solar industry, according to analysis firm IHS.

|

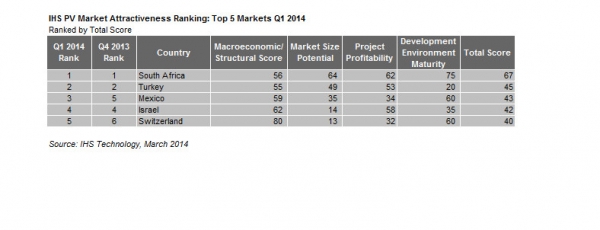

| South Africa remains as number one for solar attractiveness, having been put at the top position in the IHS Emerging PV Markets Attractiveness Index in the final quarter of 2013. Number two on the list is Turkey, followed by new entry Mexico. Rounding out the top five are Israel in fourth place and Switzerland in fifth. Image: IHS Technology. |

IHS Technology has issued the first of 2014’s 'IHS Emerging Solar PV Markets Tracker' reports, surveying the global scene as the first quarter of the year comes to an end. The attractiveness of each region is judged against four key categories; macroeconomic climate, potential market size, pipeline maturity and project profitability.

Emerging solar markets are defined by IHS as countries that are yet to install more than 1GW of PV. The report assesses each country’s PV industry from utility scale to off-grid sized systems, detailing parameters that include policy incentives, regulation, electricity and system prices, pipelines held by developers, key suppliers and financing agreements.

Mexico’s estimated 300MW currently under construction has pushed the central American country into third place. IHS predicts that a total of 327MW of PV generation capacity is expected to be installed in Mexico this year. Mexico’s state-owned utility, the Federal Electricity Commission (CFE), announced plans this week to form partnerships with private companies to promote renewable energy generation.

South Africa remains at number one for solar attractiveness, having been put at the top position in the IHS Emerging PV Markets Attractiveness Index in the final quarter of 2013. Number two on the list is Turkey.

Rounding out the top five are Israel in fourth place and Switzerland in fifth. Romania, which was third last year among emerging markets, now slips to number nine in the ranking, mainly due to a halving of government subsidies which was enacted in January.

Other notable conclusions reported by IHS are the inclusion of the Phillippines in this year’s top 10, with around 117MW to be added in the Southeast Asian island nation this year compared to a mere 3MW in 2013, and the revelation that while PV project development in Chile has finally begun to pick up pace, the decision by developers to sell at spot market prices instead of through more competitive power purchase agreements (PPAs) could suppress future power prices.

Explaining the situation in Chile, Josefin Berg, senior analyst at IHS, and one of the report’s two authors, said: “IHS is flagging it as risky that a too-high concentration of PV projects under merchant schemes will suppress future power prices. Close to 1GW of PV projects is looking for financing in Chile, and revenues could face risks even if only a third of those are connected to the same nodes and linked to spot prices.”

IHS also pointed out that emerging markets still carry an element of risk in the ability of transmission grids to reliably add increased renewable energy generation capacity as well as the unpredictable nature of regulatory support schemes. As regulatory support has been cut suddenly and drastically in countries in the west, the IHS report argues there is a risk this could also happen in emerging markets in the near future.

The other author of the report, IHS senior director Ash Sharma, wrote a blog for PV Tech at the end of last year entitled 'Why 2014 PV installation forecasts are all likely to be wrong', after 2014 installation predictions Sharma made were at odds with global forecasts made by rival analysis firm Solarbuzz and Deutsche Bank.

Consultancy firm Ernst & Young on Tuesday released the latest edition of its quarterly Renewable energy country attractiveness index (RECAI) report. Ernst & Young predicts that new markets will boost investment in clean energy this year, citing Uruguay, Malaysia, Indonesia, Kenya and Ethiopia among countries to watch for.

|