Polysilicon producers top U.S. federal tax credits

Jan 12, 2010 - Mark

Osborne - Fab and Facilities - PV-tech.org  In

respect of the US$2.3 billion U.S. federal tax credits issued last week for job

creation, two key trends have emerged. As already

highlighted, the solar sector garnered approximately US$1.0 billion of the

credits allocated. However, another trend emerged whereby three major polysilicon

producers garnered the most from the credits in the solar sector. In

respect of the US$2.3 billion U.S. federal tax credits issued last week for job

creation, two key trends have emerged. As already

highlighted, the solar sector garnered approximately US$1.0 billion of the

credits allocated. However, another trend emerged whereby three major polysilicon

producers garnered the most from the credits in the solar sector.

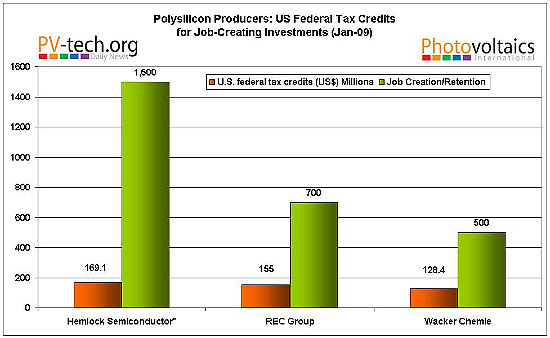

U.S.

owned and based, Hemlock Semiconductor received credits of US$141.8 million with

US$27.3 million going to Dow’s silane plant that will feed Hemlock's polysilicon

plants. Dow also owns Hemlock, which brings the total credits to US$169.1 million.

Norwegian firm, REC Group, saw its U.S. arm, REC Silicon, awarded approximately

US$155 million for its recent expansion project at Moses Lake, Washington. REC

Silicon also has a polysilicon plant in Butte, Montana. Germany’s, Wacker

Chemie is also building a new polysilicon plant in Bradley County, Tennessee,

and was awarded US$128.4 million in tax credits. As the tax credits are

for job-creating investments, Hemlock has already stated that it expects approximately

1,500 permanent jobs to be created from the new Clarksville, Tennessee plant.

Wacker has stated approximately 500 jobs will be generated and although

REC has not stated new job creations, it has stated in financial reports that

it currently employs more than 700 in its silicon division. In total, approximately

2,700 direct jobs are being secured against the tax credits. This, of course,

is aside from the construction and engineering jobs created for the projects until

completion.

|