Solar and Solyndra top venture capital funding in 2009, says Cleantech Group report

Jan 08, 2010 - Mark Osborne - PV-tech.org

According to new figures from the Cleantech Group and Deloitte, VC investments in companies in the solar sector, reached US$1.2 billion or 21% of the share in 2009, making it the largest ‘Cleantech’ sector for investment. Clean technology venture investments in North America, Europe, China and India totalled US$5.6 billion in 557 deals. However, as these figures are preliminary, the firms expect the final figures could be up by as much as 10%.

"Utilities continue to bring their capital and access to credit to the cleantech sector and are playing a key role in getting more projects off the ground. In 2009 we saw a surge in utility Power Purchase Agreement (PPA) announcements with Solar Thermal and Solar PV accounting for 80% of the total PPAs, while Wind saw increased capacity announcements in the second half of the year aided by the extension of the production tax credit," said Scott Smith, U.S. Clean Tech leader for Deloitte. "Additional project financing came from large corporations whose direct investments in cleantech increased by 14% in the second half of 2009 compared to the same period in 2008. Leading global utilities and non-utilities are likely to continue to see cleantech projects as an attractive investment from an economical and regulatory perspective."

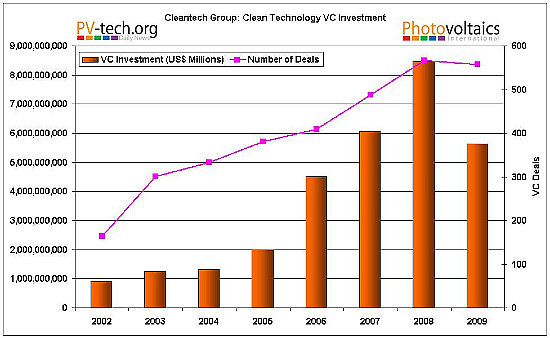

Venture investment was down 33% in 2009, compared to US$8.5 billion in 2008, yet investment in cleantech declined less than other sectors, despite the economic recession.

Solar investments in 2009 were down 64% from the previous year, according to Cleantech Group, while investment in 4Q09 (of US$187 million) was a new 3 year low for the sector.

The largest deal in all sectors was Solyndra’s US$198 million to expand its CIGS thin film production. The company has since filed for an IPO.

|