Accelerating Solar: A Look at the Next DecadeMai 3, 2010 - Dr. Charlie Gay - Applied Materials*Dr. Charlie Gay is responsible for the solar efforts of Applied Materials, a supplier of photovoltaic processing equipment. Earlier this year, in a talk at the Industry Strategy Symposium, hosted by the Semiconductor Equipment and Material Institute (SEMI), Dr. Gay talked about how he expects photovoltaic solar power to evolve in the next decade, and the factors that will drive that evolution. This is an excerpt from his talk. There is a lot of price pressure and cost pressure in the photovoltaics industry. Much of that is coming from the scale that’s happened and the capacity that’s been installed. We’ve seen costs come down fairly rapidly in addition to those prices coming down and that’s helping make this technology evolve and grow even faster. (Many) of the markets are geographically significant — Germany and Europe more broadly — but what we’re seeing is also a lot of change and growth happening in China, in India, in the U.S. and other parts of the world. Many parts of the world already have electricity rates that are over $0.40/kWhr. Solar today averages $0.25/kWhr. In almost all of Africa, Pakistan, Hawaii, Italy and large portions of Japan, the price of electricity is already in excess of what the cost of electricity is coming from solar. Solar can make a difference and what’s exciting is that the markets can grow as the industry grows. We’ve had a lot of different opportunities to be able to scale this industry in an organic and continuous fashion.

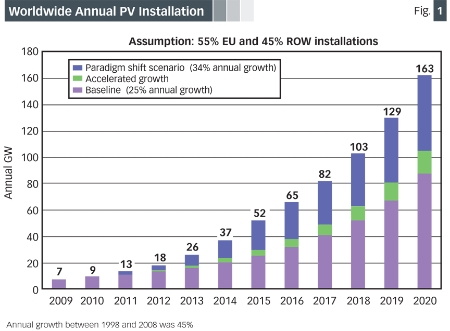

In addition to that, we’re starting to see new kinds of manufacturers get involved. Companies from the automotive sector are just as significant today as many of the integrated circuit companies that got involved in solar early on, Cypress Semiconductor being an example of a company that was the source of funding that created SunPower. Today, we see TSMC and companies like Samsung and LG, for example, increasing their engagement in what’s happening in this industry and bringing the expertise of the manufacturing sector to bear on what’s happening in the scaling of photovoltaics. I just visited BYD in China. You probably know that very well as a company that Warren Buffett invested in for their auto business. But they have a very large-scale LED manufacturing business, a very large-scale solar manufacturing business and a very large-scale advanced battery manufacturing business. They see a convergence happening here where storage–which they’re working on for their electric car–can be scaled in a way to meet utility needs. There are also companies like Nokia that are making everything from cell phones to large screen displays to cars. Give them an active involvement in the way manufacturing can be done and bring those together with the market expertise that they have. There’s a lot of change that’s happening and a lot of that is happening on ever smaller localized scales. That’s the parallel to the Internet. Those localized scale uses are now being connected to these manufacturing industries that can be sustained as local economies. We’re also seeing large-scale companies. You know the market becomes significant when companies such as Siemens and General Electric and Bechtel get involved in what solar can mean and we saw those companies enter this field in the past year. Where solar goes today is largely in grid-connected applications. There’s about 15 GW of solar installed in the world today, over the last 35 years of manufacturing. It’s roughly divided equally into what goes onto residential rooftops, what goes onto commercial buildings like hotels or commercial malls and what goes into distributed power plants connected into an infrastructure that already exists. All of these systems can take advantage of the information age, where the performance and the value of electricity varies by time of day. Where solar makes a big difference is in the time of day. It matches where electricity is needed during the hot summer afternoons when we all run our air conditioners. The utility-scale market is a relatively new one. It’s that market segment that caused that roughly 45 to 50 percent (cumulative annual growth rate) over the last few years. That sector has been the one that’s the most volatile for the last year and a half because of the financial crisis. These are larger-scale power projects. The ability to provide financing is what has made this particular piece of the market segment vulnerable recently, but which is also the segment that will be growing most dramatically. There are a variety of forecasts about how wide the scale of the industry can be. Everybody tends to put boundary conditions on this from a baseline to a high growth scale depending on what the government policies are relative to energy. And, whether we like it or not, Washington, Beijing, Brussels, all of the major government centers around the world are actively involved in energy because energy is a key part of our society’s growth and our infrastructure. We need to be paying attention to where those growth rates occur. Roughly speaking between now and over the next decade out to 2020, the range is somewhere between 80 and 160 GW worth of scale by the year 2020. What that translates into is roughly a scenario in which 3 percent of the electricity used around the world comes from solar over the next decade. What that means in the near term is some significant changes in where that electricity is being generated and what people are doing with it and what kinds of policy shifts we see. While we see challenges looming on the horizon in Germany in particular, the corollary to that is that we see huge incentives coming in the China market. Those Chinese manufacturers that have been exporting a lot of the product are creating their own domestic market to help fuel the growth. We see the same thing happening in Japan, where the existing high price of electricity is already helping to increase the demand for photovoltaics and where companies such as Sharp, Kyocera, Sanyo, Mitsubishi Electric, all have opportunities for having both a domestic as well as an international business take off. Where solar fits and where it has the greatest opportunity is in meeting peaking power needs. Not all electricity is made equal here. Being able to meet the requirements on a hot summer afternoon as well as being able to meet baseline load requirements are certainly two sections of where solar can make a big difference. Where photovoltaics has already proven itself over the last decade has been in meeting that peaking demand. The potential here on a worldwide basis is that’s about 10 percent of the electricity that’s needed and what that means broadly speaking is that there’s the potential for about 800 GW worth of overall business over the next decade or so. The scale of the possible market in that 80 GW number for 2020 would occur if we matched 10 percent of that peaking need by using solar. The value of solar in this context is that time-of-day value. The best way to get time-of-day value and information is by the Internet. It’s used by every individual being able to see what their cost of electricity looks like, being able to adjust their behaviors and by being able to bring choices to bear on where that electricity comes from.

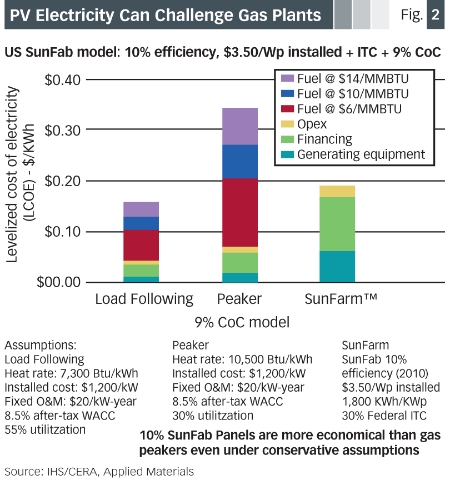

Figure 2 illustrates the role of key technologies. Load following, which means, for example, being able to have combined-cycle gas turbine systems that match the latter part of the peaking, and gas peaking turbines which is just like taking a 25 to 30 MW engine off of a 747 and putting it on a pipeline somewhere where you need electricity to meet that time of day energy need. On the far right (of Fig. 2) is the cost of what would come from a thin film solar fab. It assumes that the total installed price is around $3.50/Watt which is about where a lot of the large-scale systems are being priced today as they’re being installed. It assumes that here in the U.S. where we have an investment tax credit that’s applicable to a large number of utility or independent producers. It also assumes the cost of money is about 9 percent. You can see that solar is, roughly speaking, a little more than half of the current price of using a peaking turbine to meet that peak time of day electricity need here in the U.S. There’s a range of locations we tend to map out when we look at the U.S., those being places like California and North Carolina (which has a lot less sunlight than they do in California). There are bounds on the cost of energy depending on how much sunlight there is and there are bounds on what the cost of money looks like. More than anything else, of course, the cost of money makes the biggest difference because solar is really the ultimate capital good. You pay now for solar to get free electricity for the next 30 years. You have to pay for it all at once. When you run a coal-burning power plant or a nuclear plant, you buy the fuel as you consume it. The capital is partly spent on the installed capability and partly spent on fueling that facility. Sunlight is free, so once you’ve spent that capital, you are able to run that system in a very predictable way, because one of the things that’s happened over the last 35 years is that people have been able to monitor systems over the entire history of that 35 years, have been able to establish test standards that replicate how well those systems will work when they’re installed in the field and to know with a great deal of confidence how much energy will come for each of those peaks Watts that are installed on Day 1. If we were to be able to change the cost of capital for solar just to match what the cost of capital is for rural electrical cooperatives across the U.S., where the cost of capital is 2 percent, then solar would not only compete with peaking power, but it would also be competing with load following power. Government policy and the ability to access capital are the two key drivers which have helped this industry grow at the rate at which it has grown in the last decade. Author: Dr. Charlie Gay was named president of Applied Solar and chairman of the Applied Solar Council at Applied Materials Inc. in 2009. As president, Dr. Gay is responsible for positioning the company’s solar efforts with stakeholders in the industry, technical community and particularly governments around the world. As chairman of the Applied Solar Council, Dr. Gay leads a forum on solar-related initiatives and strategy related to technology and market development. Dr. Gay has a doctorate in physical chemistry from the University of California, Riverside. He holds numerous patents for solar cell and module construction and is the recipient of the Gold Medal for Achievement from the World Renewable Energy Congress. |

Updated: 2003/07/28

Of the changes that are happening, we see a lot coming from China. We see utilities in China where there are basically less than 10 major utilities already getting actively engaged in solar and becoming vertically integrated. A utility in China is very different than a utility in the U.S. so those utilities are able to bring the market along with the manufacturing. Many of them today make their own aluminum, for example, as part of how they do load leveling. Rather than worrying about pumping water uphill for storage, they use that nighttime power to create other products. Several utilities have already taken large steps toward getting to large-scale manufacturing. Many of them are becoming significant players, able to bring down the total costs across the value chain.

Of the changes that are happening, we see a lot coming from China. We see utilities in China where there are basically less than 10 major utilities already getting actively engaged in solar and becoming vertically integrated. A utility in China is very different than a utility in the U.S. so those utilities are able to bring the market along with the manufacturing. Many of them today make their own aluminum, for example, as part of how they do load leveling. Rather than worrying about pumping water uphill for storage, they use that nighttime power to create other products. Several utilities have already taken large steps toward getting to large-scale manufacturing. Many of them are becoming significant players, able to bring down the total costs across the value chain. A lot of the opportunities that can be made possible are being made possible today by combining the Internet with transparency of energy information. In the U.S., it takes about 15 minutes to see what’s going on on the grid. We don’t see what’s happening in real-time; we see what happened in the past. China actually leads the world in the sigma phasor technology that allows the information of real-time energy to be seen on the grid and for that to be transparent to everbody. China is not likely to have a scenario happen like we did here where Enron manipulated the energy markets because you can’t see where the energy is, what the time of day value of the energy is and how the energy is being used. As we combine the Internet with energy, it will be clear to everybody and it will be clear what the real cost of energy is rather than paying one, average, levelized cost.

A lot of the opportunities that can be made possible are being made possible today by combining the Internet with transparency of energy information. In the U.S., it takes about 15 minutes to see what’s going on on the grid. We don’t see what’s happening in real-time; we see what happened in the past. China actually leads the world in the sigma phasor technology that allows the information of real-time energy to be seen on the grid and for that to be transparent to everbody. China is not likely to have a scenario happen like we did here where Enron manipulated the energy markets because you can’t see where the energy is, what the time of day value of the energy is and how the energy is being used. As we combine the Internet with energy, it will be clear to everybody and it will be clear what the real cost of energy is rather than paying one, average, levelized cost.