Rebound:

US Photovoltaic Market Growth through 2010 Dec 15, 2009 - Larry Sherwood,

Anneke Hohl, Eric Paul and Jon Guice, PhD - renewableenergyworld.com

Recently, AltaTerra Research presented a national web conference on the American

solar market with Jon Guice, an expert on U.S. solar market entry, and Larry Sherwood,

author of the annual "U.S. Solar Market Trends" reports published by the Interstate

Renewable Energy Council (IREC). We believe the information shared—including

actual installation data collected from a wide variety of sources and locations

in a highly diverse and fragmented national market—to be the freshest, latest

authoritative look at the U.S. market, and we would like to share a few of the

highlights with you here.

In these highlights, we focus on the market for grid-connected

photovoltaics (PV) in the U.S. We recognize that the U.S. is not the dominant

market for PV in the worldwide marketplace and encourage interested readers to

look at world data to round out the information presented here for a complete

picture of the global market. Within the scope of the U.S. market for grid-connected

PV, the insights we provide here include actual data through 2008, estimates for

2009 and projections for 2010. Data Through 2008 The

data presented in this web conference come from Larry Sherwood’s ongoing

work with IREC, and are based on a wide variety of about 40 sources around the

country, including government sources and analysis of actual installations. Some

of these sources are publicly available, such as the California Solar Initiative

database, which is updated weekly. While anyone can access the data from these

public sources, it is a challenge to understand and compare the data due to differences

in reporting. For the purposes of the web conference, for example, all data

was converted to DC watts. Another challenge in analyzing the data for PV installations

is determining in which year the installation happened since most of the data

comes from incentive programs. We attribute installations to the year in which

payment was made. The installation of many projects near the end of the year makes

a big difference in how many installations are accounted for in each year.

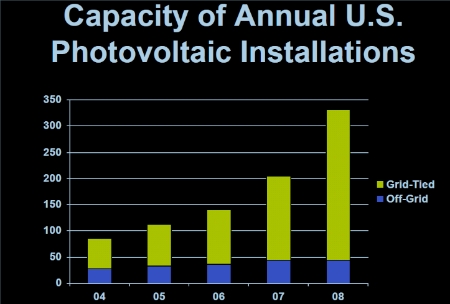

Chart

credit: IREC As shown in this chart, the total capacity of off-grid PV installations

in the U.S. has been growing at a modest rate over the past 5 years. The real

story is the growth that has been occurring in the grid-tied market. Prior to

5 years ago, off-grid installations accounted for more than half the market. In

2008 they accounted for only about 15% of the market. Projections

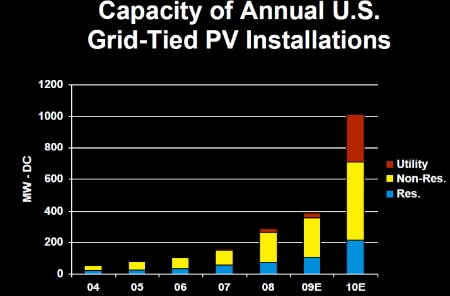

for 2009 and 2010 The chart below shows installed megawatt (MW)

capacity for grid-tied installations through 2009 and 2010 (estimated). The data

is broken down by residential, non-residential and utility installations. Residential

and non-residential installations are defined as on-site installations on the

customer side of the meter. In utility installations, the power goes into a bulk

power market and is resold by the utility to its customers. Utility installations

include fields of PV panels, and some instances of utility installations on customer

buildings.

Chart

credit: IREC In 2008, the residential market was a little more than a fourth

of the total market. The non-residential, commercial and institutional market

was the largest portion, with most of the largest installations financed through

power purchase agreements (PPAs). In 2009, we do not expect much change in the

distribution of the market share between residential, non-residential and utility

installations. Despite the dire press about what is happening

in 2009, the reality is that 2009 has been a good year for installations in the

U.S. Based on available data for installations to-date, known installations that

are in the pipeline, and announced large projects that we expect to be completed

by end of year, we estimate a growth rate of 25-40% for 2009. This does not account

for projects that remain under construction at the turn of the year. While this

growth is slower than the past several years, in which we saw growth rates in

the 50-75% range, it is still growth, which is especially good in hard economic

times. In looking at individual incentive programs, every program is experiencing

healthy growth rates of 25-80%. In 2010, we expect growth rates for grid-tied

PV in the U.S. to accelerate up to and perhaps beyond the growth rates of previous

years. Module prices are decreasing, opening up new market opportunities. The

federal stimulus is also going to have a big impact. For example, the rules for

the cash grant program, which is being offered as an alternative to the federal

tax credit, were just announced in July, so most projects under that program will

not be installed until 2010. The utility-scale market is projected to grow to

300 MW by 2010. There are also a number of federal installations on the horizon,

with direct funding being provided for solar projects on government buildings.

In addition to other federal and state programs and the ongoing popularity of

incentive programs, all signs point to a good year in 2010. Overall, we anticipate

a U.S. grid-tied PV market on the order of 1 GW (1000 MW) in 2010. This

may leave some readers wondering why our expectations for 2009 and 2010 are lower

than most projections from other analysts—particularly those that are taking

positions in relation to publicly-traded stocks. Part of the answer is that the

information presented here is based on bottom-up analysis of the market, a much

more data-intensive approach than the top-down approach used by many stock analysts. For

further details, you can find the complete presentation and archived recording

from the web conference at AltaTerra Research's website. The full conference

included state-by-state market data, issues such as financing, module prices and

project size growth, trends and connections to solar thermal markets, and key

factors driving the market in 2010.

|