Solar PV Builds Momentum Across Europe

|

| Photo Credit: Emerging Energy Research |

Jul 24, 2008 - renewableenergyworld.com

After years of being labeled a German phenomenon, the

solar photovoltaic (PV) sector is building momentum across

Europe, particularly in Spain. Catalyzed by newly adopted

feed-in tariffs, PV development activity in Europe is booming

and project size is scaling - causing shifts in competitive

positioning along the project development value chain, according

to a recent study from Emerging Energy Research, a leading

research and advisory firm analyzing clean and renewable

energy markets.

After years of dominating the solar PV industry, Germany

has been joined by Spain's scaling market and together the

two countries are setting the pace for PV development. Spain,

Europe's fastest growing PV market, is forecasted to install

800 MW in 2008 and grow to 5.6 GW by 2012, according to

EER. With long-term and relatively stable incentive regimes

in place, total installed grid-connected PV capacity in

Germany and Spain amounted to 1,440 MW in 2007, accounting

for 92% of the 1,562 MW installed in Europe.

| "As the solar PV industry

landscape adapts to lucrative feed-in tariffs, new markets,

and supply chain bottlenecks, participants are beginning

to target segments along the value chain that can leverage

their core capabilities in manufacturing, system integration,

and project ownership," says EER senior analyst Reese

Tisdale. |

Together, six countries--Germany, Spain, Italy, Greece,

France, and Portugal--are expected to hold the lion's share

of PV development activity over the coming years by adding

22 GW from 2008 through 2012, according to EER. But the

establishment of high feed-in tariffs in emerging markets,

including the Czech Republic, Bulgaria, and Switzerland

has set off a wave of PV development activity. Developers

are now positioning for first-mover advantage to establish

operations in these emerging PV markets, according to EER.

"The European solar PV market is becoming increasingly

fragmented across the value chain from manufacturers to

project owners with installers and developers operating

in the continuum," according to EER senior analyst Reese

Tisdale. Emerging PV-based power producers range from leading

renewables utilities to specialized solar PV plant owners

looking to gain market share. "As the industry landscape

adapts to lucrative feed-in tariffs, new markets, and supply

chain bottlenecks, participants are beginning to target

segments along the value chain that can leverage their core

capabilities in manufacturing, system integration, and project

ownership," says Tisdale.

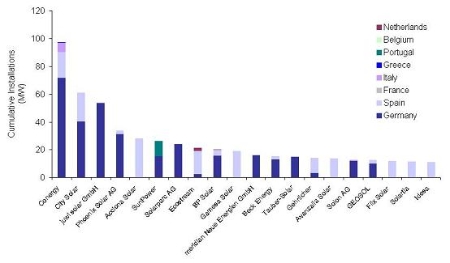

German Developers Look to Southern Europe for PV Development

With several markets emerging simultaneously and a new

focus on Southern Europe, German project developers and

investors are expanding their activities beyond their home

market to compete in the larger European landscape, according

to EER's study. These players must navigate local permitting

and feed-in tariff regulations, develop local capabilities,

and finance new levels of growth. Leveraging their development

experience in the German market and existing vendor relationships,

leading German developers including Conergy, City Solar,

and Phoenix Solar are now entering Spain, Italy and other

Southern European markets to take advantage of feed-in tariff

incentives.

Leading European utilities--including EDF-EN, Iberdrola,

Electrabel, Enel, and Edison--have become increasingly interested

in PV. "Given their existing contacts with commercial and

industrial clients, and a proven appetite for renewables,

European utilities are well-positioned to enter the PV generation

market as the sector transitions toward rooftop installations,"

says Tisdale. Independent power producers, led by Acciona

Solar and AES, are looking to continue expanding their renewable

portfolios to include solar PV moving beyond wind, solar

CSP, small hydro power, and biomass.

An emerging group of specialized solar PV power plant producers

are also aiming to capture the fruits of their development

efforts. These players include Idesa, Renewagy, Solarparc,

SunEdison, and S.A.G. Solarstrom. "While the European PV

market remains extremely fragmented, in terms of plant construction

and plant ownership, emerging players are positioning themselves

to be specialized solar IPPs alongside larger renewable

players like Acciona or AES," says Tisdale. "For the most

part, their strategies leverage their long track record

gained in their home markets, secure module supply, and

access to capital through financing partners."

Supply Chain Challenges Scaling PV Market

On the supply side, the pace of technology change and a

global shortage in silicon supply have together presented

significant challenges to PV project developers and integrators,

according to EER's study. New technologies, such as thin

film, are driving costs downward and undercutting the traditional

silicon based module suppliers.

"The downside of rapid growth--typical of such a quickly

scaling industry--has been the supply chain's inability

to keep pace with demand," says Tisdale. As a result, developers

across the value chain have been pressured to secure not

only their existing positions but also to switch to less

efficient--but less expensive--technology (e.g. thin film),

to move toward vertical integration, or to lock in long-term

supply agreements to compete more effectively. "To survive

the currently evolving market environment, developers' nimbleness

will be critical to their ability to keep up with solar

PV's increasingly frenetic pace," says Tisdale.

ABOUT THE STUDY - SOLAR PV DEVELOPMENT STRATEGIES IN

EUROPE 2008-2020

EER's market study, Solar PV Development Strategies in

Europe, 2008-2020, released in June 2008, provides comprehensive

analysis of PV market activity in Europe with a focus on

downstream development activities. The 300-page study profiles

leading project developers, supply chain strategies, geographic

positioning, and opportunities across 30 countries. Follow

this link for the study's Table of Contents and List of

Exhibits. For more information please contact Stephanie

Aldock at 617-551-8483 or eermedia@emerging-energy.com

ABOUT EMERGING ENERGY RESEARCH

Emerging Energy Research is a leading advisory and consulting

firm analyzing clean and renewable energy markets on a global

basis. EER is based in Cambridge, Massachusetts and Barcelona,

Spain. Our clients - which include many of the world's largest

energy companies, utilities, technology vendors, and financial

institutions - seek our informed, objective view and advice

on these fast developing markets. For more information visit

www.emerging-energy.com

|