US Solar Spins a 360Dec 8, 2009 - Elisa Wood - Renewable Energy World.COM The solar industry is finally feeling optimistic again, having apparently achieved a full 360 degree turn over the past 12 months, but what will 2010 hold?

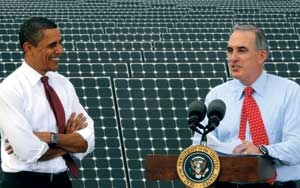

‘The economy had started to weaken. But I don’t think anyone at that time appreciated how tough it was going to be and how long it would take to rebound’, said Mike Hall, Borrego’s CEO. Fast forward a year. It’s October 2009 and this time even more people – at least 24,000 – make their way to California for the SPI conference. Its organizers, the Solar Energy Industries Association (SEIA) and Solar Electric Power Association (SEPA), are impressed by the number of vendors that have set up on the conference floor, more than 900, double that seen the year before. Barack Obama is President, federal money is flowing into the solar industry, and state policymakers are vying hard to attract solar businesses to their states. ‘I really see the conversion of many different factors that give us reason to have much more optimism. With good foundation’, said G. Robert Powell, president and CEO of Solar Power Partners, a California-based independent power producer. So the industry is bullish again. But will 2010 live up to its promise or be another roller coaster ride? The Good and Bad of Low Prices The good news is that prices for solar installations continue to drop. That’s also the bad news. In early 2009 prices fell too fast. Hall says the slide was so rapid, customers hesitated to make deals because they weren’t sure if the market had reached bottom. ‘It is very difficult to get people to sign a contract when prices are declining so fast’, Hall adds, observing: ‘Why should I buy now when every month when I don’t buy it becomes cheaper?’ Long term, however, falling prices are good for the industry, as they make solar more competitive. Prices for installed photovoltaic systems declined 30% over the last decade and 4% over the last year, according to a study, ‘Tracking the Sun II’, released in October 2009 by the Lawrence Berkeley National Laboratory (LBNL). Prices initially dropped for non-module parts of a project, such as the labour, marketing, overhead, and inverters; more recently, module prices have fallen too. ‘This dynamic began to shift in 2008, as expanded manufacturing capacity in the solar industry, in combination with the global financial crisis, led to a decline in wholesale module prices’, said the report, which looked at 52,000 grid-connected PV systems installed between 1998 and 2008 in 16 states. Average installed costs dropped from $10.80/W in 1998 to $7.50/W in 2008. But prices varied significantly between states. Arizona was the cheapest solar state in 2008 with an average rate of $7.30/W for a system no larger than 10 kW; followed by California, $8.2/W; Colorado, $8.3/W; Connecticut, $8.6/W; and then Massachusetts, New Jersey, New York and Oregon at $8.7/W. Highest costs were $9.90/W in Pennsylvania and Ohio. While final figures are not yet in for 2009, early numbers suggest a further drop in costs. The LBNL report looked at projects that had not yet been installed in 2009, but had won approval to receive incentives in California and New Jersey, the states that house 95% of US solar PV. It compared their expected costs to the price tag of projects installed a year earlier. In California, average costs came out to $6.7/W, or $0.7/W lower than 2008. In New Jersey, projects approved in 2009 were $6.9/W, compared with $7.6/W for 2008. The decline occurred across all system sizes. The report also found that states had been decreasing the direct cash incentives offered to projects, at least as of late 2008. But the move was offset by an increase in federal money. The average value of state and federal incentives was $4/W in 2008 for commercial PV systems, a slight drop from a peak in 2006, but still a near-record-high. Residential systems, on the other hand, were at an historic low in 2008 when it came to incentives, averaging $2.90/W, the most depressed level in 11 years, the report said. Too Much Costly Paperwork Is the drop in residential incentives bad news? Given the new economics of solar projects, what the industry may need now is not more incentives, but less paperwork, says Barry Cinnamon, CEO of Akeena Solar, a California-based installer. Cinnamon began thinking about this when he installed panels on his own home and counted 148 pages of documentation for compliance filings, building permits, incentive applications. While all other costs associated with a solar project declined, the cost associated with meeting regulatory and filing requirements has increased from 50 cents/W in 2001 to over $1.50/W now. ‘The next biggest cost area is to try to figure out how to reduce that paperwork and bureaucracy’, he says. Paperwork reduction may not work for large-scale projects, but it makes sense for those under 10 kW, according to Cinnamon. Costs have come down so low for installations, homeowners may prefer foregoing incentives over hassling with the documentation. Given the falling module cost and the ease of installation – once a 20–30 hour job on a roof and now a 5–6 hour task – the next big cost saver may be elimination of bureaucracy, he says. Utilities Live up to Promise While 2009 took an unexpected swerve because of the recession, one segment of the market stayed on course. Pundits had predicted utilities would begin streaming into the solar market, and they did. Solar accounted for 13% of all new utility announcements and filings, up from 6% last year, according to the Edison Electric Institute. Utilities are expected to play a leading role in developing the 20,000 MW of new solar over the next decade predicted by the North American Electric Reliability Corp. ‘What we saw this year was the full-scale entry into the marketplace by utilities. They got serious this year about building solar power plants’, said Powell, who joined SPP after serving as a senior executive at California utility, Pacific Gas and Electric (PG&E). Utilities were drawn into the market after the federal government first began allowing them to use the federal tax credit for solar development. But that was not the only attraction. ‘I really think it is as a result of the utility industry being more focused on clean energy’, Powell said. Their green focus comes as consumers demand cleaner power and states accelerate renewable portfolio standards – requirements that utilities and retail suppliers meet a percentage of their demand with green energy. In some cases, state leaders simply wielded more carrots and sticks to move utilities into solar. Meanwhile, Florida now has bragging rights to the largest solar PV plant in North America, the 25 MW DeSoto Next Generation Solar Energy Center, built by utility Florida Power & Light and California-based SunPower. The $150 million project, which began operating in October, supplanted Nevada’s Nellis Solar Power Plant as the continent’s biggest PV plant. Now FPL is attempting to secure approvals to expand DeSoto, with an eye toward eventually producing 300 MW from the project. ‘In the past year, we have seen a significant increase in plans for large-scale solar projects’, said Julia Hamm, executive director of SEPA, adding: ‘Electric utilities are stepping up to take a leadership position on the expansion of the role of solar in our nation’s energy portfolio.’ A May 2009 report issued by SEPA found that California has maintained its ranking for top utility involvement in solar development. PG&E had the largest solar capacity in its portfolio: 84.9 MW, as of 2008, the year surveyed. Other California utilities on the top 10 were Southern California Edison at number two with 32.4 MW, and San Diego Gas & Electric third with 16 MW. Sacramento Municipal Utility District ranked ninth with 2.9 MW. Looking ahead, the report found that utilities have a tremendous number of solar projects on the drawing board – 7500 MW of capacity. The study concluded: ‘Utility-scale solar electric projects have entered a new phase of market development in which they will be the primary solar industry megawatts and cash-flow drivers. In addition, utility-driven projects are a new and emerging dynamic in the solar industry whose impact is still being played out.’ Utilities were viewed as a relatively safe bet by the wary credit markets in 2009 because they enjoy a guaranteed rate of return and cost recovery through regulated customer rates. While this has helped spark a boom in PV construction, CSP has moved more slowly, despite the utility-backed long-term contracts held by several projects. PG&E’s number one ranking for last year came solely as a result of PV projects, not CSP. However, more than 6000 MW of CSP has been proposed in the US. In 2009 FPL began construction of the Martin Next Generation Solar Energy Center, a 75-MW parabolic trough project that will be the first plant in the world to connect a solar facility to an existing combined-cycle gas-fired power plant. With 200,000 mirrors on 500 acres (202.5 ha), the project is expected begin operating in 2010. Meanwhile, CSP experienced a setback in Arizona, when Starwood Energy Group canceled a power purchase agreement in late September with Arizona Public Service (APS) for the 290-MW Starwood Solar I project. Starwood and building contractor Lockhead Martin cited unexpectedly high construction costs that made the deal uneconomical, though they are considering a smaller project at the site. At the same time, APS continued to move forward with its 280-MW Solana CSP project. The utility expects to announce financing and ground breaking for Solana in 2010. In addition to pushing CSP, APS is among a number of utilities that are attempting to make solar energy easier and cheaper for its retail customers to install on their homes and businesses. APS is leveraging its access to capital markets to cover upfront costs. The utility has proposed a pilot project where customers can sign up on the utility website and 10 days later have PV panels on their roofs without making any initial capital outlay, according to Don Brandt, APS CEO. APS installs, owns and maintains the panels, customers pay for the power on their utility bills under rates fixed for 20 years. The utility proposed the programme because even with federal incentives a home solar installation costs $10,000 to $15,000. ‘That’s a lot of money for people to finance. In this economic climate, it is difficult’, said Brandt. APS plans to generate 1.5 MW of solar from the so-called ‘Community Power Project’ scheme. Similar initiatives are in the works at other utilities. Duke Energy, for example, won state regulatory approval in May for a project to install 10 MW of solar on homes and businesses in North Carolina at no upfront cost to the consumer. The company owns and maintains the modules and pays the customer a rental fee for hosting the panels. In New Jersey, PSEG received approval from the state Board of Public Utilities in August to build 80 MW on customer sites. The utility owns the system, and as with Duke, pays the property owner a rental fee for housing the project. PSEG expects to invest $515 million on the programme, which will double installed solar capacity in the state. The idea of relieving customers of upfront costs through long-term arrangements is not a new one. For several years now independent solar companies have engaged in such deals through the solar power purchase agreement (SPPA), a third-party contract between installer, investor and customer. An approach that grew in use dramatically in recent years, the SPPA ran into trouble in late 2008 and early 2009 as investors became scarce. The contract relies on a federal tax credit, valuable to investors looking for tax relief against profits. However, with the economic crash, profits dried up, so fewer companies needed tax relief. The federal government eased the problem somewhat by offering a ‘grant in lieu of’ credit that gave projects upfront cash instead of an after-tax credit. North America also began moving toward accepting another innovation that eases renewable energy costs by spreading them over the long term, known as the feed-in tariff. While the approach has been used for years in Europe, it could not get traction in North America until recently. The feed-In tariff provides guaranteed payment to renewable energy generators for their output under long-term agreement. Ontario lawmakers in May approved a generous tariff that pays C$ 44.3–80.2 cents/kWh (US$ cent 42–76/kWh), depending on the size and type of solar project. In northern New England, Vermont initiated a feed-in tariff of US$ cents 30/kWh in October for solar PV projects of at least 2.2 MW. Vermont plans to accept up to 50 MW of renewable energy under the tariff. For solar projects, the contracts will run as long as 25 years. Vermont’s governor initially fought the idea. He later relented somewhat, refusing to sign the law, but also declining to veto it. So the tariff became law without his signature. Douglas argued that Vermont did not need the tariff to attract renewable energy, and that developers could build projects without such financial assistance. Other states also have new or improved feed-in tariffs in various stages of enactment, including California, Hawaii and Oregon. While solar is clearly on the US radar screen as never before, significant policy battles lie ahead, chief among them is the passage of climate change legislation and a national renewable portfolio standard. To rally supporters, Rhode Resch, SEIA president and CEO, issued a solar bill of rights at the 2009 SPI conference. Resch takes on several inequities faced by solar in his bill of rights, calling for fairness in the ability to install solar on one’s property, to connect solar to the grid, and to net meter at full retail rates. Resch also challenges what he describes as an unfair competitive environment. ‘It’s the most basic right there is – equality under the law. Today, solar has anything but. And that’s not just an opinion, that’s a fact’, he said. ‘From 2002 to 2008, federal subsidies for fossil fuels were $72 billion while solar received less than $1 billion. This is completely disconnected with the desires of the American people.’ Resch said the solar industry faces two alternatives: ‘Go big. Or go home.’ Indeed, big seems to be the direction, given recent announcements like that of silicon wafer manufacturer MEMC Electronic Materials saying that it will purchase Maryland-based solar project developer SunEdison for $200 million by year’s end. In announcing the deal, MEMC said it sees a growing market ahead for solar. SPP’s Powell views the SunEdison deal as a sign of improvement, along with thawing credit markets, heightened investor interest and falling solar costs, which will make 2010 a strong growth year. Borrego’s Hall also sees ‘a really big year’ ahead. His company will enter 2010 with a record backlog of signed contracts. ‘There is a lot of pent up demand’, he said, but added: ‘There was a huge sense of optimism after the last conference followed by a harsh reality. Now we’ve returned to optimism again. We’ll see what materializes in 2010. We’ve done a full 360 in 12 months.’ Elisa Wood is US correspondent for Renewable Energy World magazine. |

Email this page to a friend

Borrego Solar Systems saw the stars align in 2008. The California contracting firm expected to break records, and it did, earning revenue of US$58 million, nearly double its previous year’s performance. But Borrego had expected more. When company officials left the 2008 Solar Power International (SPI) conference in October, buoyed with optimism, they had looked toward closing out the year with revenue of $60–$80 million.

Borrego Solar Systems saw the stars align in 2008. The California contracting firm expected to break records, and it did, earning revenue of US$58 million, nearly double its previous year’s performance. But Borrego had expected more. When company officials left the 2008 Solar Power International (SPI) conference in October, buoyed with optimism, they had looked toward closing out the year with revenue of $60–$80 million. In Massachusetts, for example, the state legislature passed a new law that lets each utility build up to 50 MW of solar photovoltaics, an unusual turn in a state that prohibited utility ownership of any generation under liberalization rules passed a decade ago. National Grid and Northeast Utilities immediately stepped up to the plate with 11 MW of solar projects and the promise of more to come. The state also plans to enact a solar carve out, a specific RPS requirement that pertains only to solar installations. Projects under 2 MW will be eligible to produce what are known as S-RECs, solar renewable energy certificates. S-RECs are a source of revenue for projects because utilities and retail suppliers purchase the certificates to meet their portfolio standard requirements. In all, Massachusetts governor Deval Patrick hopes the new programmes will attract 250 MW of solar to Massachusetts by 2017, a goal that has helped draw Borrego,

In Massachusetts, for example, the state legislature passed a new law that lets each utility build up to 50 MW of solar photovoltaics, an unusual turn in a state that prohibited utility ownership of any generation under liberalization rules passed a decade ago. National Grid and Northeast Utilities immediately stepped up to the plate with 11 MW of solar projects and the promise of more to come. The state also plans to enact a solar carve out, a specific RPS requirement that pertains only to solar installations. Projects under 2 MW will be eligible to produce what are known as S-RECs, solar renewable energy certificates. S-RECs are a source of revenue for projects because utilities and retail suppliers purchase the certificates to meet their portfolio standard requirements. In all, Massachusetts governor Deval Patrick hopes the new programmes will attract 250 MW of solar to Massachusetts by 2017, a goal that has helped draw Borrego,