First the iPhone. Now Renewables.Jun 18, 2012 - Mitsuru Obe - wsj.com TOKYO - When Masayoshi Son heard about the nuclear meltdowns in Fukushima last year, he had a mini meltdown of his own. The chief executive of telecommunications and Internet company Softbank Corp. 9984.TO +2.87% - these days best known as the man who brought Apple Inc.'s iPhone to Japan - says he told his board he was so concerned by the accident that he couldn't concentrate on his job anymore. Mr. Son said he planned to quit and work on energy issues instead. "We had a big, big fight," Mr. Son told attendees at a renewable-energy conference earlier this year. "Shouting - banging the table." The volatile Mr. Son was ultimately persuaded to stay. But he has also become one of the most outspoken advocates of a new energy era in Japan, arguing that solar and wind power, and some outside-the-box thinking, could take the place of electricity generated by nuclear reactors - and many fossil-fuel plants as well. The challenge is immense. Before the March 2011 earthquake and tsunami sent three reactors at the Fukushima Daiichi plant spinning out of control, nuclear power accounted for around 30% of Japan's total supply, and the government was proposing to raise that to 50% by 2030. Alternative-energy sources like solar power, by comparison, made up less than 1% - one of the lowest percentages in the developed world. Mr. Son now proposes replacing all of Japan's nuclear generation with renewable energy, including hydroelectric, for a whopping 50% to 60% of Japan's total energy production by 2030, one of the most ambitious targets anywhere. Mega-Solar Plants

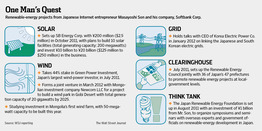

To jump-start that growth, Mr. Son - whom Forbes lists as the third-richest man in Japan, with an estimated net worth of $6.9 billion - is wasting no time. His audacious plans include 10 mega-solar plants in Japan, six of which are either under construction or soon will be. A new Softbank subsidiary was created to invest in and manage the projects, in cooperation with local governments and corporate partners. Softbank so far has agreements with 36 of Japan's 47 prefectures to develop renewable projects, including plans for solar plants on abandoned farmland in Minamisoma, a city just north of the Fukushima Daiichi nuclear plant. Local governments have widely embraced Mr. Son's renewable-energy plans, says Masaru Kaneko, a professor of economics at Keio University. Local political support is crucial in a crowded country where land ownership is fragmented and land use highly regulated. Softbank is seeking preferential tax treatment and regulatory exemptions from the prefectures, which in turn are expected to provide land and some financing. The bulk of financing for the projects will come from Softbank and corporate partners. Mr. Son also is championing what he calls a "crazy, crazy idea" to connect Japan with other countries in Asia in an electricity "super grid" through which Japan could import wind and solar power from Mongolia. In March, it signed an agreement with Mongolian investment firm Newcom Group and Korea Electric Power Co. KEP +0.85% to explore a joint wind-power project in the Gobi Desert. Beating the OddsKnown for his political influence and deal-making savvy, Mr. Son has won against-the-odds battles before. As a software distributor in the 1980s and 1990s, he helped Microsoft Corp. MSFT -1.13% and other U.S. companies crack a Japanese computer market then dominated by domestic hardware makers peddling proprietary operating systems. In the early 2000s, he lobbied hard for deregulation in telecommunications, leading a charge that ultimately pushed Japan - and his company - to the forefront of broadband deployment globally.

To help his current cause, he created a foundation for policy research and lobbying that develops and promotes policies supportive of renewable energy. Among other efforts, it organizes public seminars and provides counterarguments in running public debates about how best to meet Japan's energy needs in the future. But critics, including energy analysts, say Mr. Son's plans to increase Japan's reliance on renewable energy to as high as 60% are a stretch at best. Wind and solar power are inconstant, notes Hisashi Hoshi, an analyst at the Institute of Energy Economics, Japan's largest energy think tank. If Japan moves ahead with renewables on the scale Mr. Son is proposing, critics add, the country will need to even out power fluctuations with expensive measures like power-storage facilities or a redesign of the electricity grid. Mr. Son knows his agenda is provocative. But he clearly senses opportunity in Japan's energy industry, which is under pressure to open up to more competition. Japan's power industry currently is controlled by nine regional utilities with near-monopolies on their markets, and little interconnection between the parts of the grid they control. Those utilities have historically concentrated their research efforts on nuclear power, rather than renewable energy. Next month, Mr. Son's dreams may catch a break when Japan starts requiring utilities to buy solar or wind power from independent companies, the type of regulation that has supported alternative-energy development in Europe. Asian Super GridFar higher hurdles remain, however, for an Asian super grid. Cross-border electricity grids aren't unheard of, but they're tough to execute. Norway and the Netherlands started preparations to connect their electricity grids in 1994, but didn't complete the 580-kilometer link until 2008. A 125-mile cable could be strung between Japan's southern island of Kyushu and South Korea, with a capacity of around 700 megawatts -similar to the Norway-Netherlands cable, says Hiroshi Takahashi of Fujitsu Research Institute, an expert on international grids. Such a cable would let Japan import power from Korea - where rates are around one-third those of Japan's - as well as points farther west like China or Mongolia. Mr. Son estimates that Mongolian wind power would cost around three to four yen (four to five cents) per kilowatt-hour, if land for wind farms could be leased virtually free. Transferring power to Japan would cost two yen per kilowatt-hour, making the total cheaper than the roughly nine yen per kilowatt-hour the country pays for nuclear power, he says. Japan's Electricity Business Act, however, doesn't allow foreign companies to supply electricity in Japan. And passing legislation to change that law in Japan's current divided Parliament won't be easy. Politicians and bureaucrats also worry about what would happen if supplying countries refuse to sell Japan the electricity when there is a power shortage. Mr. Son is soldiering on. "Let's connect Japan to other Asian countries, and make them compete," he told lawmakers in April. "We import oil and gas. What's wrong with importing electricity?" After the meeting, Mr. Son admitted his goals are tough ones. "If everybody is just watching, nothing will move forward," he said. "We see it as our role to take risks among uncertainty and set precedents, so other people will follow." Mr. Obe is a staff reporter in the Tokyo bureau of The Wall Street Journal. He can be reached at mitsuru.obe@wsj.com. A version of this article appeared June 18, 2012, on page R7 in the U.S. edition of The Wall Street Journal, with the headline: First the iPhone. Now Renewables.. |